Airstream Alpha Newsletter Archive

Every Tuesday/Thursday, @TheFundCFO publishes VC/CFO insights that matter – highlights from notable VC GPs, LPs, and CFOs/finance pros. Love what we’re doing? Consider upgrading to paid for deeper dives on Thursdays (most paid subscribers expense these insights!)

#305: State of Venture (2025): What Changed?

What was the state of venture in 2025? What changed? What does this mean for the year ahead in 2026? For answers, we dove in to CB Insights’ State of Venture: Global 2025 and CEO Manlio Carrelli’s latest breakdown - here’s what really changed.

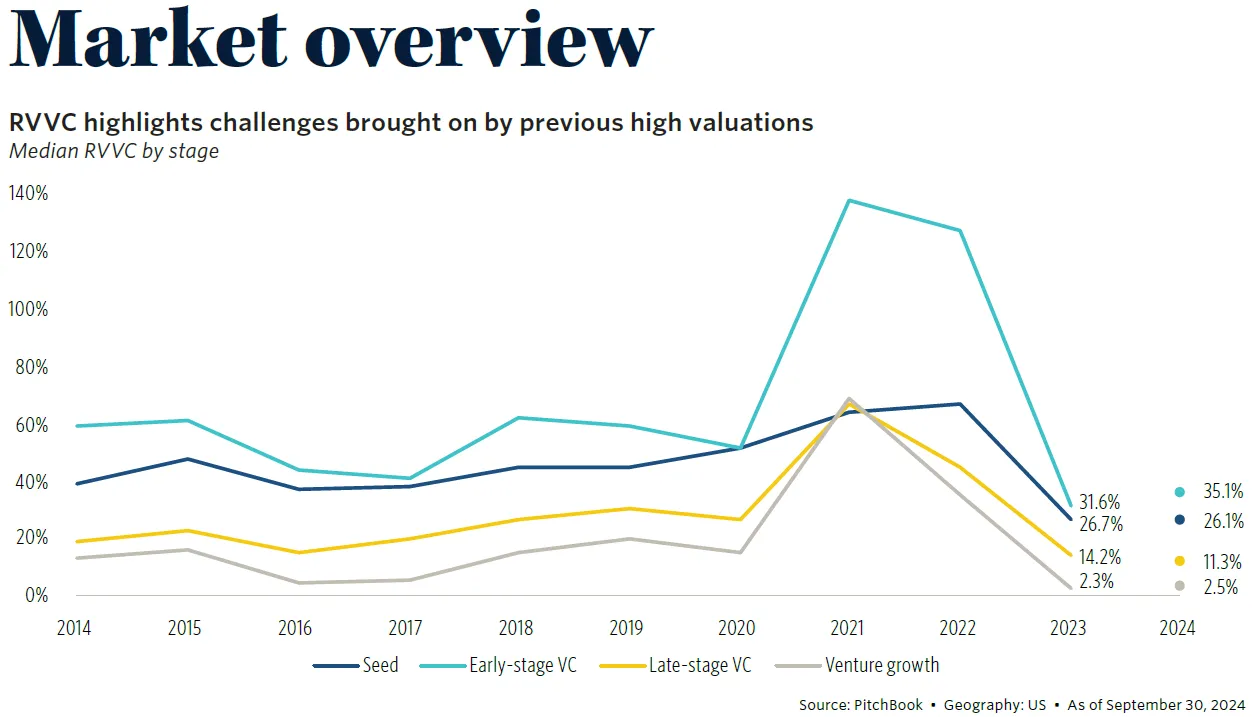

#304: VC Valuations / Revenue in 2026

A question we’ve been hearing more often lately: what is the relationship between VC valuations and revenue?! How much revenue do I need to raise a Series A, B, C, etc.?! We have answers - let’s dig in to the latest data to find out!

#303: 2025 Data & The Impact On 2026 Outlook

What does 2025 data tell us about the 2026 operating environment? What follows is a snapshot of the conditions GPs, founders, and fund operators are working within as the quarter gets underway.

#302: 2026 Outlook & Top Predictions Summary

As we head into 2026, a useful way to frame the year ahead is not what will win, but what constraints may finally loosen. Two thoughtful forecasts approach 2026 from different angles, but converge on a few practical themes. Out of all the prediction summaries floating around out there, these are our favorite takeaways (below) most relevant to this audience.

#301: Top Posts of 2025 (All-In-One)

As we wrap 2025, it’s time to pause and revisit something simple: The key topics & posts readers consistently came back to this year. Not because they offered definitive answers—but because they helped frame the right questions. Across dozens of posts, a handful stood out as reader favorites and touchstones throughout the year. Below are the themes — and the posts behind them — that resonated most.

#300: Q4’25 Recap & Top Posts!

Happy (almost) end of Q4 folks! Below, we’ve grouped the key themes from Q4 and linked back to the top posts where each theme resonated the most! - Liquidity Moved From Debate to Planning - Performance Dispersion Became Harder to Ignore - Valuation & Audit Discipline Took Center Stage - A “Healthy Market” Looked Selective, Not Busy - What Q4 Reinforced for Fund Operators

#299: Navigating the 2025 Liquidity Drought

As 2025 wraps up, one theme cuts across nearly every VC and LP conversation: the liquidity drought. Fundraising cycles are slower, pacing has tightened, continuation vehicles are more common, and hold periods have extended well beyond historical norms. These dynamics have reshaped how managers think about reserves, DPI, and exit planning. In this post, we dive deeper into one mechanism that actually resets liquidity cycles: public markets.

#298: Q3 2025 Fund Performance Highlights

Aduro Advisors gave us a preview of its Q3 2025 Fund Performance Benchmark Report they’re releasing shortly, offering a structured, data-driven view of how private funds are performing across strategies, fund sizes, and vintage years. The report is built from fund-level source data rather than self-reported inputs, providing managers and LPs with a clearer baseline for comparison.

#297: Q4 Valuation & Audit Time: What’s New?

It’s quarterly valuation & audit time again — dashboards open, KPIs refreshed, comps updated, and valuation memos circulating. Compared to the earlier part of the year, Q4 brings its own rhythm: year-end audits approaching, LP updates underway, and a natural moment to revisit how your valuation process is working. What follows is a grounded walkthrough of what we typically see in Q4, where teams tend to focus, and how to approach valuations with clarity and consistency — without implying that one method or policy fits all situations.

#296: What's a “Healthy” Venture Market? Are we there yet?

Early-stage venture has never felt more crowded. More firms. More capital. More noise. And with AI accelerating everything, bigger checks are flowing downstream — earlier and faster than ever before. A new analysis from Elizabeth “Beezer” Clarkson offers one of the clearest looks we’ve had at what’s actually happening under the surface. Short answer: It’s not broken. It’s concentrated.

#295: November Recap: Power Laws, Fund Math, & More

As November wraps up, we have signals—not certainties, but patterns worth paying attention to. It was a month of power laws, fund math, mechanics, and perspective. Here’s a look back at core ideas and posts that resonated most.

#294: A 5x VC Fund Is Rare - But It's Not a Myth

There’s a narrative in venture right now: “5x funds are unrealistic.” “Those days are over.” “LPs should lower their expectations.” That framing is emotionally convenient — but financially incomplete. A recent graphic and analysis by David Clark (CIO, VenCap International) offers a clearer, more precise way to think about it. Rather than giving into pessimism, his data highlights where the real opportunity lies.

#293: AI Gravity Gap: Solid Co.'s Not Raising

The venture market in 2025 isn’t just shifting — it’s polarizing. AI has become the dominant narrative, and the result is a funding environment where strong, durable businesses outside the AI arc are facing the toughest conditions of the past decade. Samir Kaji summarized this dynamic in a recent post: the data, the incentives, and the psychology of the market are all pointing in the same direction. Here’s what that looks like when you zoom out.

#292: 2025 AI Landscape & Venture Returns

Every cycle has a few defining companies. In the 2025 AI cycle, one of those few companies is Cursor. Akhil Paul’s LinkedIn post, “Cursor’s Generational Growth Curve,” highlights how unusually fast Cursor is compounding relative to modern SaaS benchmarks. And alongside that, Accel’s newly released “2025 AI Globalscape” maps the broader ecosystem — showing where workflow-native AI is gaining traction, how infrastructure is compounding, and why Europe and Israel are rising faster than expected.

#291: Mid-Quarter Check-In: Models, Mechanics, Q4 Close Prep

We’re at the halfway mark of Q4, and the signals are becoming clearer: funds are operating with more focus, LPs are paying closer attention to operational clarity, and fund models are increasingly central to how decisions get evaluated. This mid-quarter check-in ties together posts #280–#290, highlighting trends, observations, and practical takeaways as we head into year-end — while leaving room for different approaches and perspectives.

#290: Concentrated vs. Diversified: Fund Model Math That Matters

The math of venture capital keeps repeating a simple truth: in a power-law world, breadth beats precision. Stefano Bernardi (Unruly Capital) published a strong piece on Signature Block, challenging the idea that concentrated portfolios outperform. It’s a belief that persists among LPs — 15–20 high-ownership positions, follow on the winners, “high conviction.” But when you model it, the numbers tell a different story.

#289: Fund Models Matter (RAISE Takeaways)

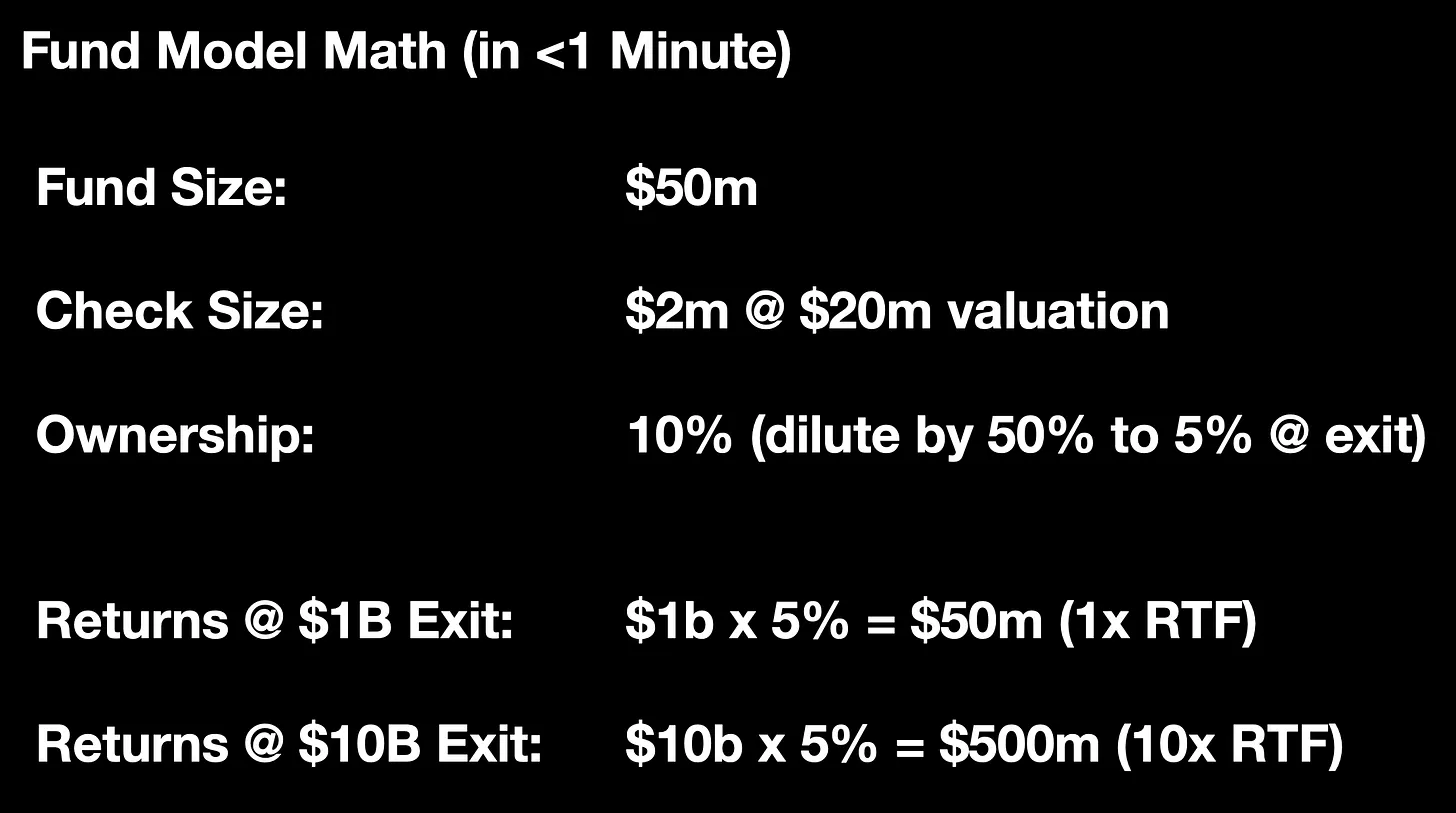

We presented Fund Models Matter session at RAISE Global 2025. The message was simple — and long overdue: Most GPs still don’t know their fund model. In a cycle where fundraising takes longer, LPs are more selective, and capital is flowing through narrower funnels, knowing your fund math is a differentiator!

#288: October Recap: Top Posts & Links

October was steady—but far from quiet. Between Q3 closeouts, fundraising resets, and a few long-awaited signs of recovery, venture started showing its first real signs of rhythm again. Here’s everything we covered this month: Ops > Optics; Tax Season Started Early; Fundraising Got Real; Venture Hit a $90B Plateau; and Inside RAISE Global 2025.

#287: Inside RAISE Global 2025 — How Fund Models Are Evolving

The 10th Annual RAISE Global Summit brought together General Partners (GPs) and Limited Partners (LPs) for a one-day, high-impact convening on the evolving architecture of venture capital. Recognized as a premier community for forward-thinking LPs and emerging fund managers, RAISE has become the nexus where capital allocators, operators, and institutional investors exchange practical frameworks for building next-generation funds.

#286: The $90B Plateau — What Q3'25 Says About Venture’s Selective Recovery

For the fourth straight quarter, venture funding hovered above the $90B mark — signaling that capital is flowing again, but through a narrower funnel. For fund managers, that signals a market where capital efficiency matters less than conviction — and only the most credible narratives are clearing IC.

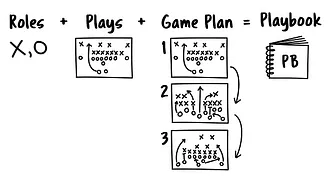

#285: Fundraising Playbook for Emerging Managers

Raising Fund I isn’t just a financial exercise — it’s an act of storytelling. Emerging managers aren’t just pitching their strategy or access; they’re pitching themselves. The real challenge isn’t building conviction — it’s translating that conviction into a narrative LPs believe in.

#284: Resources to Get a Fund Tax-Ready

Tax season is a crash course in how your fund actually works. After last week’s dive into getting your fund tax-ready, we wanted to expand on the why behind those filings — and the mechanics every GP should understand before tax prep even begins. Sydecar’s Guide to Fund Taxation lays out those fundamentals clearly. Below are the key concepts every emerging manager should internalize:

#283: Signs of Life — What Q3 2025 Tells Us About VC’s Slow Rebuild

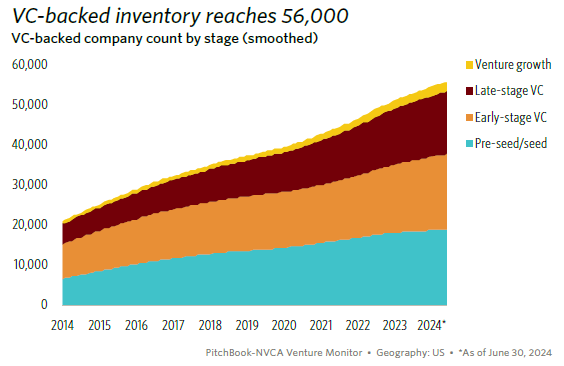

After four quarters of waiting, venture might finally be exhaling. The latest PitchBook-NVCA Venture Monitor paints a picture of cautious optimism: exits are back in motion, AI’s share of capital has (slightly) cooled, and LPs are re-entering conversations—even if selectively. It’s not a broad recovery yet. But for the first time since 2021, the data shows early indicators of a functioning market.

#282: Resources to Get a Fund Tax-Ready

Navigating your first tax and audit season can feel like decoding a new language. Between management fees, carried interest allocations, and partner K-1s, even well-run emerging funds find themselves racing to close books while prepping for the next capital call. Carta recently published its Tax-Ready VC Fund Playbook, and it’s one of the better checklists we’ve seen for fund managers who want to build institutional-grade processes early.

#281: Q4 Close Coming: Valuations, Audits, and Finance Playbook

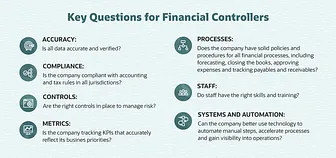

As Q4 begins, fund finance teams shift from “steady state” into close mode: valuations, audits, LP reporting, and internal clean-up. It’s the quarter where a CFO’s operational rhythm either reinforces LP trust — or exposes weak process. Here’s what the best-run VC funds focus on at quarter-end:

#280: Q3 Closing Checklist w/ Playbook, Model, Valuation Updates

If you’ve ever closed a quarter in venture, you know the feeling - a mix of curiosity, fatigue, and that quiet question: “Are we ready for what’s next?” This is where checklists matter most. They don’t just help you remember the small stuff - they make sure you don’t miss the big things when the pace picks up.

#279: Q3'25 Recap - Hiring, VC Math, & The Hits

Q3 2025 was a quarter where the venture conversation got both tactical and technical. From capital calls to convexity, the most-read posts were the ones that gave VC GPs, CFOs / Finance Pros, and LPs a clearer playbook for building LP-trusted funds. Here’s what stood out:

#278: How to Hire in VC (Real Job Data)

Stina Ladd shared insights on how VC firms scale outside of investment teams. While most of us instinctively know that AUM drives the size of the deal team, the less discussed question is: what happens to finance, operations, IR, talent, and legal as firms mature? True analyzed ~200 VC firms with funds >$200M raised in the past three years, and the findings provide a real look at how firms professionalize over time.

#276: # of Funding Rounds Req'd to $1B

We’re highlighting a deep dive into recent research from Ilya Strebulaev that pulls back the curtain on how many funding rounds it really takes to build a unicorn. Spoiler: there’s no universal playbook. But the patterns that do emerge are instructive for anyone in the investment industry.

#275: IPO Awakening?

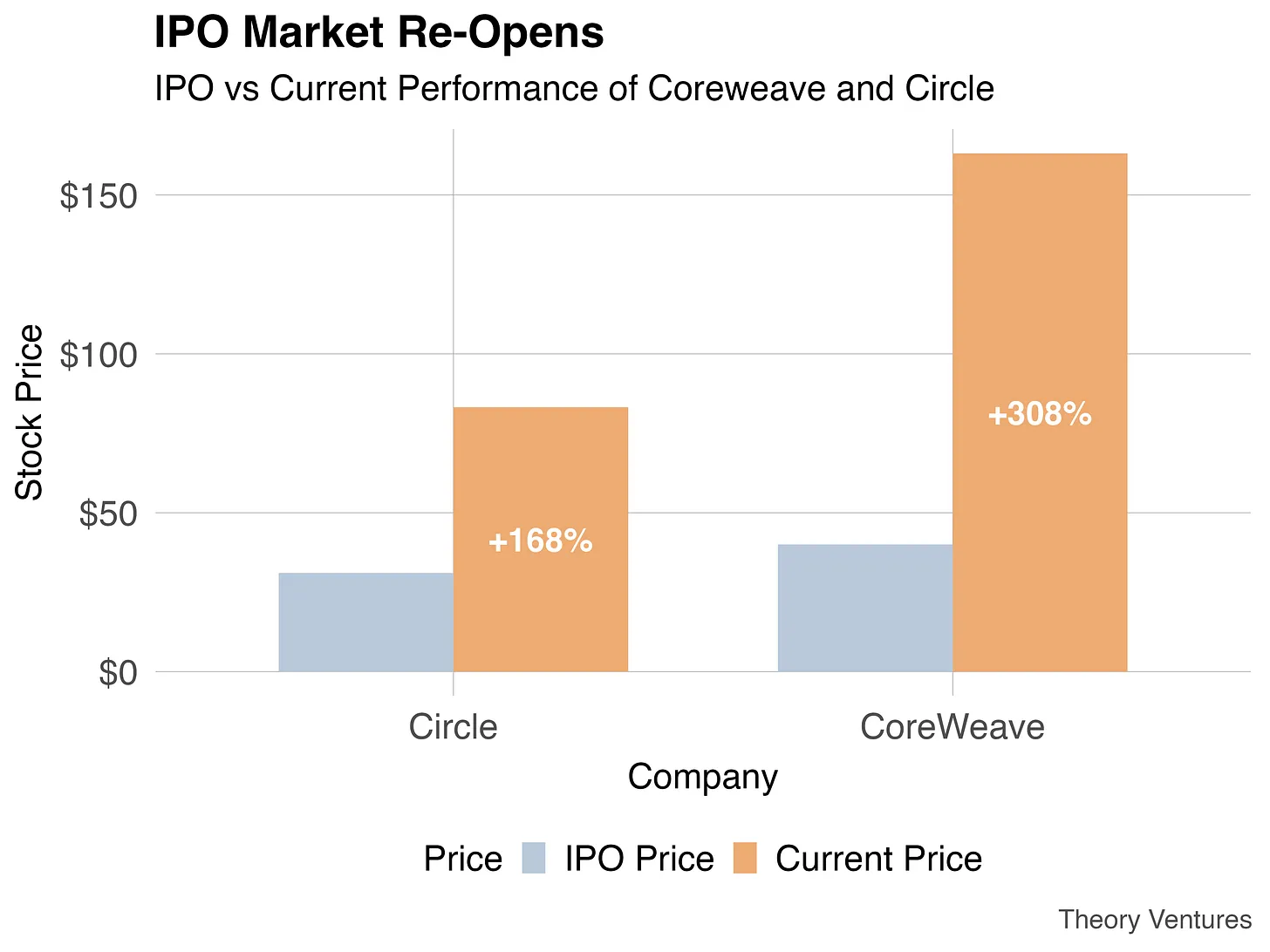

Jason Lemkin recently shared: “The IPO market has awoken.” After nearly three years of drought, September delivered the most concentrated wave of IPO activity since November 2021. More than $6 billion was raised across 8 major debuts, led by Netskope and StubHub. Is the IPO market really awake now? What does it mean for VC?

#274: VC Tactics: Capital Call Execution

In VC, capital calls are the quiet engine that keep funds running. They’re not flashy like deal announcements or exits, but for GPs and CFOs, they’re the difference between smooth operations and cash crunches. In a tactical issue, here’s a breakdown of why they matter and how to make the process less painful for both you and your LPs.

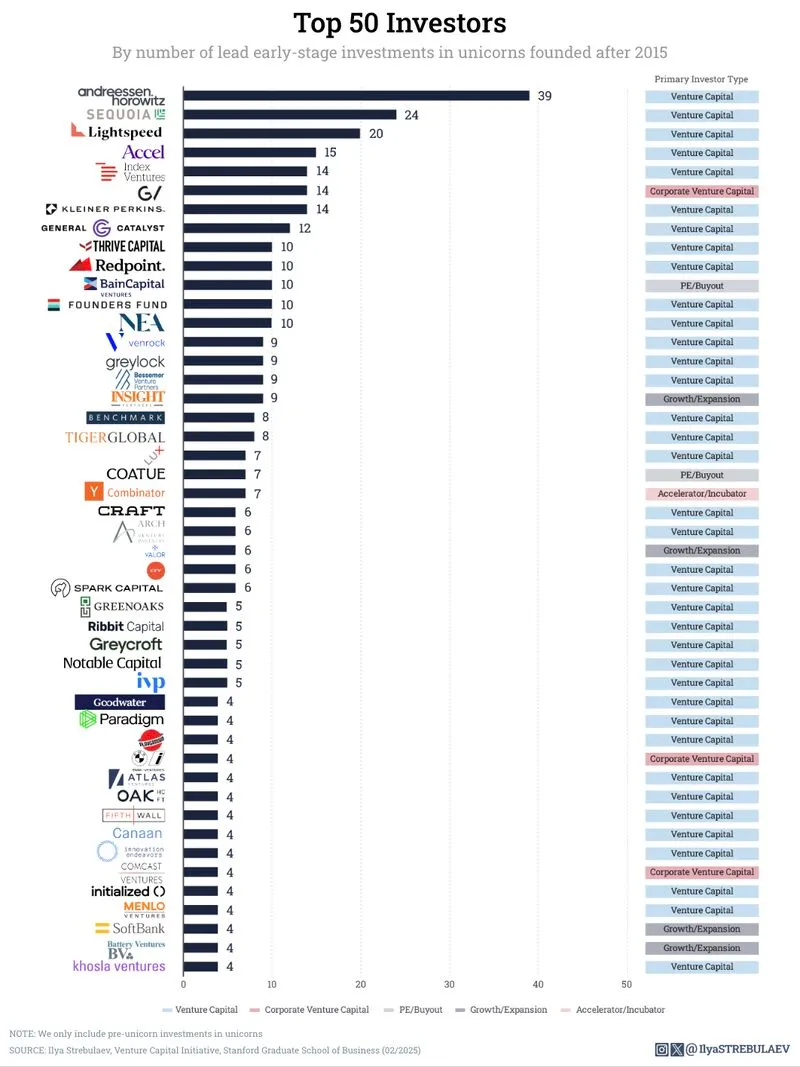

#273: New Metric: Unicorns per AUM

In VC, you often hear about “fund size,” “number of deals,” and “unicorns”, but one metric rarely discussed publicly is unicorns per dollar under management. Here’s a new metric: “Unicorns per AUM.” Top VC firms by unicorns per AUM post 2015 by Ilya Strebulaev. The funds that made the list below are worth paying attention to!

#272: Unicorn Data by VC Fund

Ilya Strebulaev’s (Stanford) latest research on venture capital hit rates offers a rare look at which firms are best at spotting unicorns early. The chart ranks funds by the share of their early-stage investments since 2020 that have gone on to become unicorns. Note that this is a recent heat index and doesn’t account for nuances such as team turnover, DPI, etc. - tbd if this persists or performs going forward!

#271: VC Fund Math: “Maximum Convexity” = 5-10x Funds

What Game Are You Playing? 2x+ funds are fine for mega-VCs. A $1b fund → $2b exit → $1b profit → $200m carry @ 20%. ✅ Most emerging managers are playing a different game, targeting 5-10x+ funds at the earliest stages of the market. Bottom line: what’s the math behind 5-10x+? More below

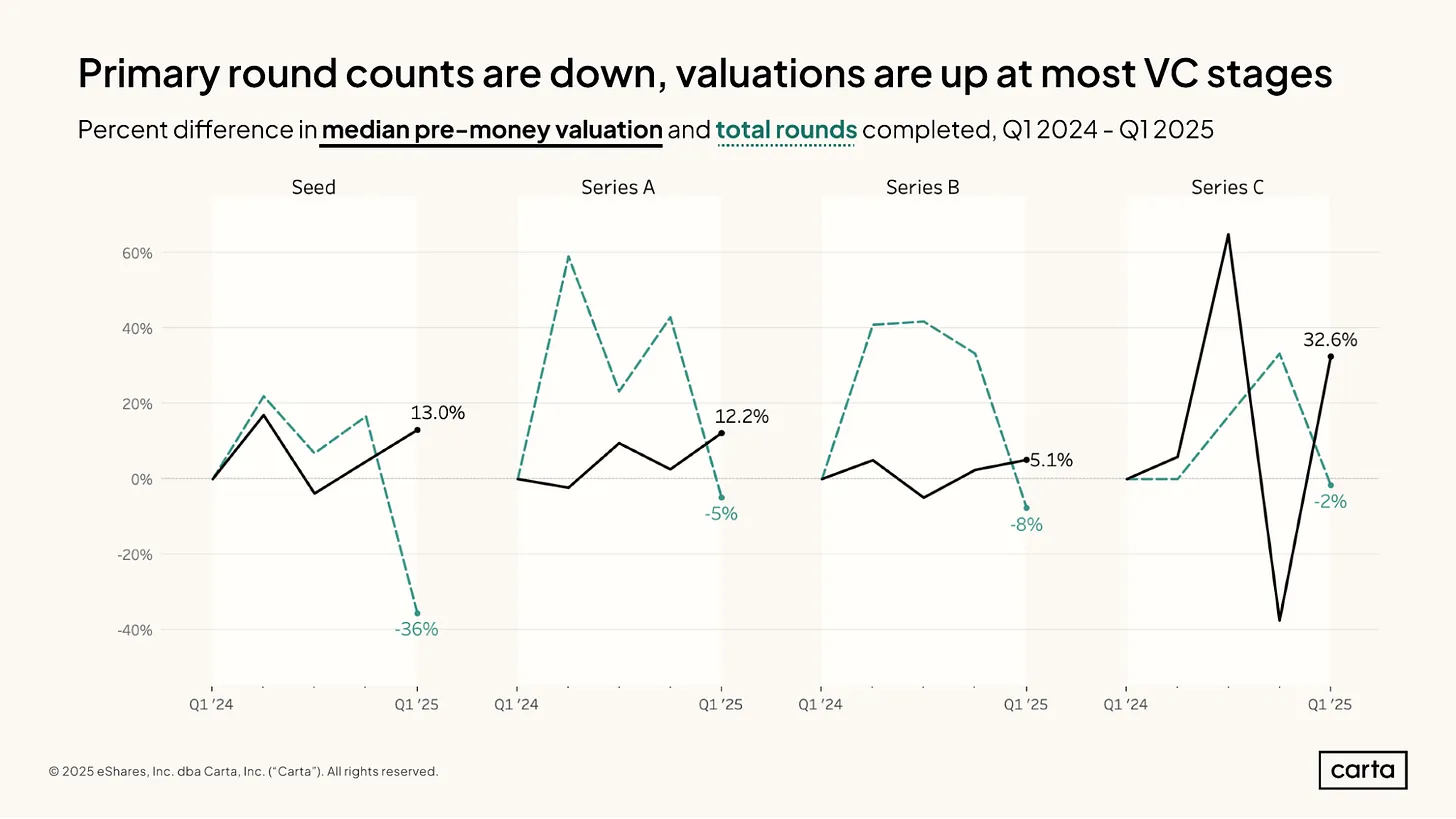

#270: VC Market in Q2'25-Lean Rounds, Higher Valuations, Bigger Efficiency

In Carta’s “State of Private Markets: Q2 2025”. startups raised smaller checks, closed fewer deals, but hit record-high valuations—especially in the early stages. The AI era is driving capital efficiency, reshaping allocation, and rewarding lean, high-potential companies.

#269: Venture Math: IRR vs. MOIC

We appreciated some key lessons / reminders in the recent post IRR vs Return Multiple Explained: The Venture Math from The VC Corner. The piece makes a strong case for why founders, VCs, and LPs need fluency in both IRR (Internal Rate of Return) and MOIC (Multiple on Invested Capital)—and how each metric, while powerful on its own, only tells half the story.

#268: PE Market Thaw: Q4 Deals Coming?

Change up - today we’re diving in to some PE (private equity) updates! PE is an important part of the private markets and can inform what’s happening in VC and other areas. Private equity dealmaking is finally showing signs of life after a sluggish first half. Advisors are seeing more sell-side mandates hit the market, and the valuation gap between buyers and sellers is beginning to narrow. That doesn’t mean PE activity is roaring back—but it does suggest Q4 could be the busiest stretch of 2025.

#267: VC Fund Models Matter: Digging Deeper on Model Insights

In venture, the deck tells the story, but the fund model drives the returns. LPs don’t commit only a strategy sounds compelling — they commit when the numbers line up with discipline, timing, and trust. Fund models matter. We’re bringing this theme to RAISE GP Day. Fund models are not academic exercises. They’re operating tools: Reserves; Waterfalls; DPI forecasts...

#266: Q2'25 VC - Concentration, AI Premium, & Hard Tech

CB Insights’ State of Venture Q2’25 shows a market still awash in capital—but with a sharper aim. Funding remains near record highs, yet deal activity has fallen to its lowest level since 2016. The new VC playbook? Fewer shots, bigger targets. Here are the takeaways that stood out to us: 📈 Funding Stays Hot — $94.6B in Q2 🤖 AI Still Owns the Cap Table 🏢 Corporate VC Pullback 🔧 Hard Tech’s Big Swing 🚀 Breakout Sectors to Watch

#265: Mid-Quarter Check-In: Fundraising, Liquidity & LP Patience

2025’s back half isn’t following the script. Fundraising is tighter, exits are selectively strong, and LPs are more patient but far more precise in where they place bets. The through-line? Proof beats promise. Here’s what’s moved — and what it signals: High-Impact View: QSBS 2.0 as a Strategic Unlock; Fundraising is a Readiness Game; Liquidity Momentum Is Building — For the Right Logos; Early H2 Exit Optimism; LP Signals: DPI Over TVPI, and more...

#264: VC Fundraising, Track Record & Data Room (2025 Edition)

Back when this newsletter was just getting started, we said every GP needs three things before raising a fund: Fundraising strategy Track record presentation Data room readiness Four years later? Same fundamentals. Higher bar. LPs have sharper filters, diligence cycles drag longer, and the “good enough” data room of 2022 no longer cuts it. This is your one-stop refresh — plus the best resource we’ve found: SVB’s Data Room Best Practices. Their 9-part manifesto boiled down, with links to our own earlier takes.

#263: VC Exits H2'25 — Liquidity Gains Momentum with Figma IPO

So far in Q3, roughly $22B in VC-backed exits have been realized. Layer in the estimated $13B+ in paper value from Figma’s IPO, and we’re projecting $35B+ in Q3 exit activity—if current momentum holds. That would make Q3 the second-best quarter in recent years, behind Q2’s $67.7B total. But important caveats apply: We’re not through the quarter yet—projections reflect early August data A large portion of “value” (especially in Figma’s case) remains locked up and unrealized The market is still sorting winners from markdowns

#262: VC Exits Looking Up in H2 2025

This week’s update builds on reporting from Sourcery’s “$FIG 250% IPO Pop + Bill Gurley”, which covered the Figma IPO and investor reaction in detail. We’re zooming in on the cap table math, the liquidity ripple effects, and what this signals for late-stage venture in H2. The exit markets just got a shot of adrenaline. This was a liquidity event that mattered—for founders, for LPs, and for GPs staring at long-dormant DPI waterfalls.

#261: July Recap: LP Signals, DPI, & Seed Round Rethink

This month wasn’t about velocity. It was about filtration. Across 8 posts, we tracked how LPs are sharpening their filters, how GPs are shifting from storytelling to structure, and how niche strategies—like QSBS optimization or operational readiness—are going mainstream. Here’s what got read the most—and why it resonated.

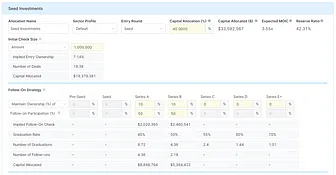

#260: From Lean to Leverage: The New Seed Round Playbook

Something fundamental has shifted in venture over the last decade. A few years ago, the $1M–$3M seed round was the norm—the bread and butter of early-stage fundraising. Today, that round size has all but vanished. As Tomasz Tunguz writes: “The small seed round has all but vanished. In 2014, the most frequent seed round size ranged between $1m and $3m. Today, that round size comprises less than 10% of rounds.”

#259: Why Data Is the Stack

In a recent episode of The Generalist Podcast, Tomasz Tunguz—managing partner at Theory Ventures—made a compelling case that we’ve entered the decade of data. His thesis: data isn’t just a layer in the stack—it is the stack. Whether you’re building with AI, blockchain, or SaaS, the real unlock comes from how you capture, structure, and activate data.

#258: VC Fundraising 2025 YTD

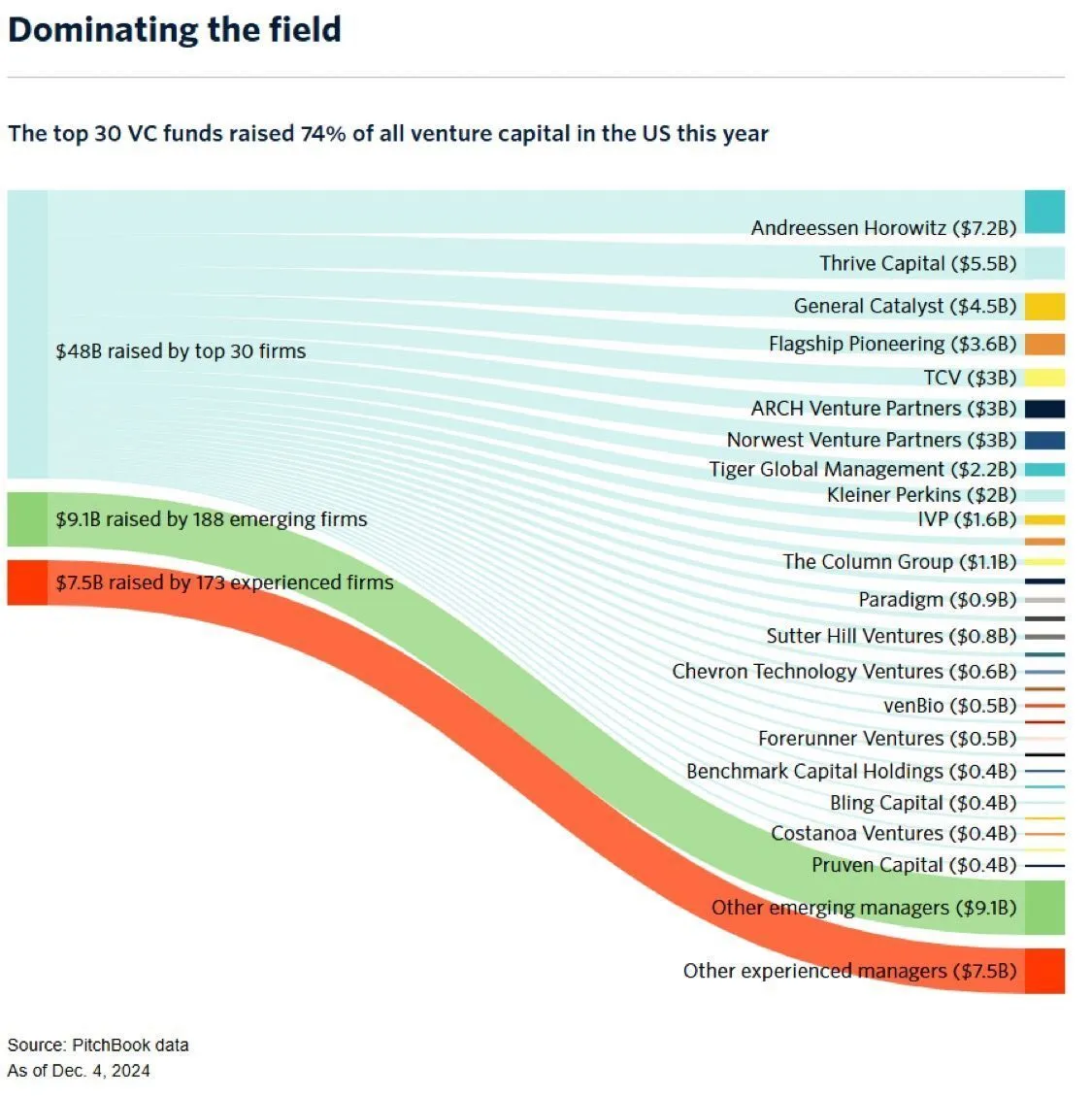

Venture capital fundraising in 2025 is increasingly a story of concentration—a market where a few firms are raising nearly all the capital. According to PitchBook’s Q2 2025 Venture Monitor, just 12 U.S. VC firms raised over 50% of all capital raised year-to-date. Let that sink in. Despite a challenging macro and distribution environment, capital is still flowing—but it’s flowing upmarket, toward brand-name managers with scale, strategy, and deep LP relationships.

#257: Liquidity on Lock, AI Leading — What Q2 2025 Really Tells Us

The Q2 2025 PitchBook-NVCA Venture Monitor, released July 14, offers a sharp look at a venture market in stasis—unless you’re building with GPUs and LLMs. From dented IPOs to bifurcated funding rounds, the report (published with J.P. Morgan, Dentons, Deloitte, and NetSuite) cuts through the noise. Here’s what matters for GPs, LPs, and founders navigating this moment.

#256: VC Midyear Update (2025): Liquidity, AI, & Secondaries

Insights from PitchBook's US Venture Capital Midyear Update At the midpoint of 2025, the U.S. venture capital market is sending mixed signals—renewed activity in AI and secondaries, but persistent headwinds in liquidity and fundraising. PitchBook’s US Venture Capital Midyear Update frames the landscape clearly: this is a market in transition, not recovery. The market has effectively split in two: This divide raises the question: How do new managers stand out?

#255: QSBS 2.0 - Faster Exits, Bigger Caps, New Playbooks

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) quietly reshaped a tax incentive that’s been a bedrock of early-stage investing: Qualified Small Business Stock (QSBS). The last overhaul was in 2010. This one’s bigger—and faster. To break it down, we’re turning to someone who knows the letter and the strategy behind the law: Chris Harvey, attorney and founder of Law of VC. Chris has helped funds, founders, and LPs navigate QSBS for years—and his analysis of the new law is the go-to reference for this update. As he puts it, “This is the most material update to QSBS in 15 years.” And it's not just cosmetic. QSBS 2.0 shifts timelines, raises caps, and reopens the door for companies and funds that thought they’d aged out.

#254: Q2'25 VC Valuation Policy & Insights

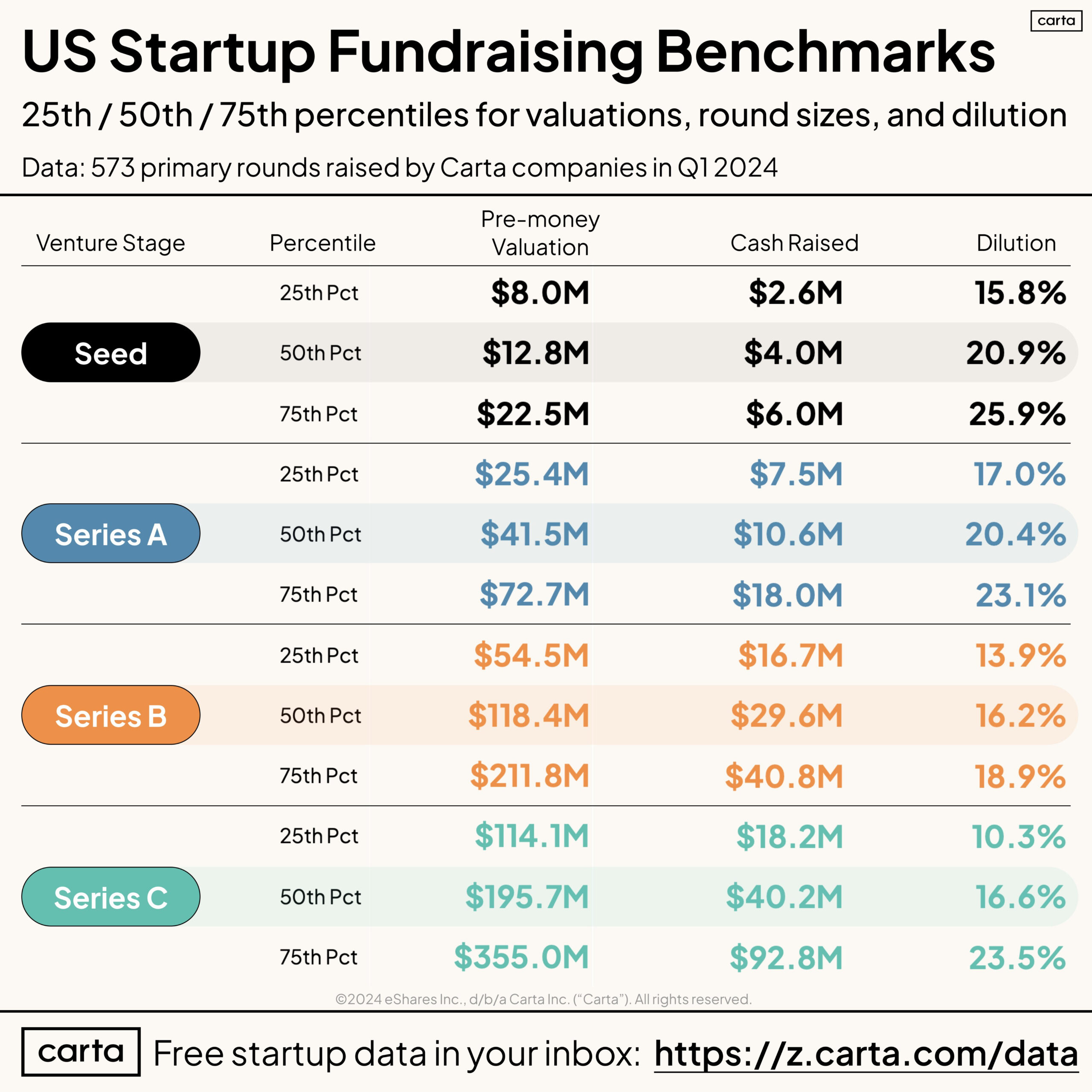

Valuation policy matters more than ever. AI dominates. The exit window creaks open. As we move through 2025, the venture market is beginning to feel familiar—but with new rules. Valuations are trending up. Deals are harder to close. Founders are getting more favorable terms—but only if they can clear a higher bar. Behind the headlines, a deeper shift is underway: valuation policies are becoming central to LP conversations, audits, and follow-on fundraising. Markups are back in style—but how you get there matters more than ever. Here’s a tactical recap of Q2 2025, with updated data from Carta’s State of Private Markets: Q1 2025, PitchBook-NVCA, and siliconAngle—and a full archive of past valuation deep dives at the end.

#253: Institutional Readiness Isn’t a Buzzword. It’s a Strategy.

Insights from Chris Harvey via Embracing Emergence: The venture capital landscape is shifting—fast. Capital is consolidating at the top, and the bar for emerging managers is rising just as quickly. In a recent piece for Benedikt Langer’s Embracing Emergence newsletter, Chris Harvey breaks down what it really means for a VC fund to be “institutional ready”—not in theory, but in practice. The market has effectively split in two: This divide raises the question: How do new managers stand out?

#252: Q2 Recap-Discipline, Duration, and the Changing Venture Stack

The second quarter of 2025 wasn’t about acceleration. It was about adaptation. Across 22 posts (#230–#251), we tracked how venture firms, LPs, and markets are responding to longer feedback loops, platform shifts, and a new kind of liquidity discipline. This wasn’t a quarter of flashy exits. It was one of deeper rewiring. Here’s what mattered—and what it signals.

#251: Raising a VC Fund in 2025: Liquidity, AI, and a Tale of Two Markets

There are now 10x more private investment firms than public companies. Let that sink in. Private markets are no longer the “alternative.” They are the market. In a conversation with Turner Novak on The Peel, Samir Kaji (CEO of Allocate) unpacked the seismic shifts reshaping private investing. His message was clear: whether you’re building a fund or deploying into one, the game has changed. So in the spirit of Pavel’s post — and in a moment of reflection — here are a few principles that guide everything we share:

#250: >1200 Unicorns: Early Backers, >25% Are No Longer >$1B

Which investors are consistently spotting billion-dollar companies before anyone else? New research from Stanford Professor Ilya Strebulaev analyzed more than 1,200 unicorns founded after 2015 and identified the VC firms that most often led early-stage rounds in companies that eventually reached $1B+ valuations. The findings offer more than just a leaderboard—they highlight how power-law dynamics and early-stage conviction shape today’s venture outcomes.

#249: Venture Equations: Power Laws, Secondaries, and the Discipline Premium

Over the past two decades, venture capital has quietly—but fundamentally—rewired itself. The rise of trillion-dollar companies, the explosion in unicorn formation, and the strategic maturation of secondaries are reshaping how funds perform, how portfolios are constructed, and how liquidity is planned. We’re not just playing a different game—we’re playing on a different board. Here’s what’s changed, and why it matters: 1. Mega-Winners Now Define Fund Outcomes 2. Portfolio Construction Has Evolved 3. Secondaries Are Now Part of the Liquidity Stack 4. Entry Prices Are Climbing—And So Is Selectivity 5. The Edge: Discipline, Diversification, and Secondaries

#248: Top VC Takes / Accounts, Unique Perspectives

@TheFundCFO started with a simple goal: help GPs operate like the best in the business — especially when it comes to building funds that LPs can trust. That means fund mechanics, capital flows, reporting, structuring — and just as importantly, learning how to communicate clearly with your investors. If you’re an emerging manager looking to stand out with institutional LPs — or a GP navigating your second or third fund with more complexity than ever — this newsletter is for you. In short: we want to help GPs build LP-trusted funds. So in the spirit of Pavel’s post — and in a moment of reflection — here are a few principles that guide everything we share:

#247: IPO Liquidity Is Back — For Real This Time?

If you’ve been following along, you already know the thesis: smaller is not a bug in venture capital; it’s a feature. James Heath’s recent piece, Small Funds, Big Wins, adds a data-driven lens to this thesis. It’s not just that smaller funds can work—it’s that, when paired with manager selection discipline, they may outperform by design.

#246: 🎧 LPs, Solo GPs, and the Power Law: Michael Kim on Backing the Best

In this rare LP-side deep dive, Turner Novak interviews Michael Kim, founder of Cendana Capital, one of the most influential limited partners backing early-stage VC managers. If you’re a solo GP, raising a first fund, or just trying to make sense of this market, Kim delivers a calm, clinical take on what works—and what doesn’t—when it comes to building durable venture franchises. This episode is also a window into how funds like Banana Capital are evolving operations. Make no mistake—Michael reminds us that in venture, tooling is leverage, but judgment is everything.

May Recap: VCs -> RIAs, LP patience, small fund power, and more

One of the most useful things about stepping back is seeing not just what’s happening—but what’s compounding. May’s posts covered the reopening of the IPO window, concentration risk in platform VCs, and the structural advantage of small funds. But across all of it, one theme kept reappearing: GPs are adapting to longer feedback loops—and LPs are adjusting their expectations for return timing, fund model, and portfolio strategy. Here’s what we covered, and what’s worth keeping in view:

#244 – Small Funds, Big Wins: The Case for Lean Venture Strategies

If you’ve been following along, you already know the thesis: smaller is not a bug in venture capital; it’s a feature. James Heath’s recent piece, Small Funds, Big Wins, adds a data-driven lens to this thesis. It’s not just that smaller funds can work—it’s that, when paired with manager selection discipline, they may outperform by design.

#243: Tech IPOs Are Coming Back. Slowly. AI Might Lead.

After a multiyear freeze, the tech IPO market is showing early signs of a thaw in 2025. The pace isn’t frenzied, but movement is real—and this time, it’s deliberate, as highlighted in a recent CNBC report. CoreWeave. eToro. Figma. Galaxy Digital. Chime. Omada Health. These aren’t just logos; they’re signals. The IPO window isn’t open—but it’s no longer frozen shut. And for CFOs, that’s a critical shift.

#242 The New Operating System for Venture

Last week, we unpacked Lightspeed’s quiet leap into RIA territory. This week, we step back—because this isn’t just one firm making noise. It’s the venture operating system getting reinstalled. A16z. Sequoia. General Catalyst. Lightspeed. They’re not just VCs anymore. They’re infrastructure. This isn’t compliance theater. It’s structural. The legacy venture model was built for spray-and-pray, LP-optimized returns, and decade-long waits.

#241 Mid-Quarter Check-In: RIA Era, Secondary Power Plays, and a Shifting Stack

We’re halfway through Q2. Time to zoom out. 2025 hasn’t just been noisy—it’s been structurally interesting. Capital is consolidating. VC firms are becoming platforms. And the “venture stack” is getting rewritten in real time. Here’s what’s moved—and what it signals: The Operating System is Changing; Valuation Signals Are Fractured; Q1 Was a DPI Mirage; Secondaries Are Becoming Infrastructure; The Traditional VC Stack is Breaking; Macro + AI = New Exit Math

#240 VC's Becoming RIA's

Lightspeed becomes an RIA—and venture enters its next era. If you looked away last week, you might’ve missed something subtle but seismic: Lightspeed quietly became a Registered Investment Advisor (RIA). With $31B under management, Lightspeed now has the structural freedom to go way beyond early-stage startups. Think: public equities, buyouts, roll-ups, secondaries. Moves that stretch the old venture model into new territory.

#239 April Recap: Broken Lines, Secondaries & Spring Swings

April was anything but boring. From navigating valuation season to making sense of a whiplash-inducing public market, this month brought a mix of practical tools, deeper context, and a few surprises. We kicked things off with Q1 valuation prep, took a closer look at 2025 policy trends, and even unpacked how macro market shifts affect private markets in real time. Here’s a look back at what we covered this month—just in case you missed a post (or want to bookmark a few for your next Monday standup)

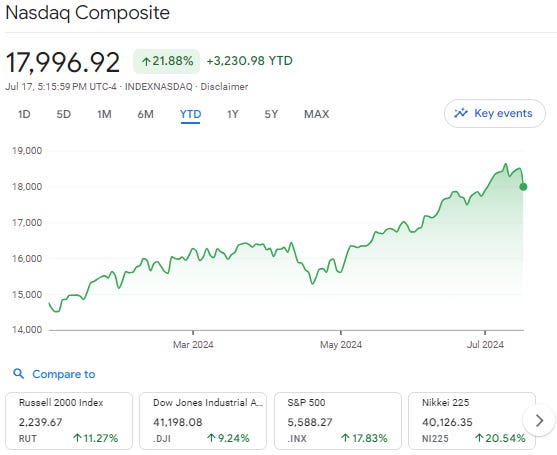

#238 IPO Window, Tariffs & AI (Spring 2025)

Markets started the spring on a hopeful note—IPOs were trickling in, AI was still riding high, and private trading volumes picked up. But then came volatility, rate jitters, and another round of U.S. tariffs. That optimism? Faded fast. But now are we back and markets back on an upward trend?!

#237 Secondaries Are (Finally) a Core Part of Seed VC

There was a time when secondaries felt like a shady side alley of venture capital—reserved for insiders, distressed sales, or late-stage cleanup. In 2025? That stigma is dead. Hunter Walk (Homebrew) just published a killer post walking through why secondaries are now essential for seed-stage investors—not optional. It’s the kind of post that reframes where the whole early-stage game is headed.

#236 "The VC Assembly Line Is Broken"

Every now and then, a piece of venture analysis slices clean through the noise. Sam Lessin at Slow Ventures just dropped a 104-page monster on where tech and venture are headed in 2025. It’s not breathless AI hype. It’s not another end-of-days thread. It’s something rarer: honest, grounded, and actually useful. This isn’t just a trend memo. It’s a mirror. And below are the reflections that stuck with us.

#235 Diving Deeper: What You Didn’t Notice in the Q1 Venture Data

There’s more in the Q1 2025 PitchBook-NVCA Venture Monitor that’s worth paying attention to—especially around valuations, sector dynamics, and deal sizes. These quieter shifts say a lot about how investors are behaving, where capital is flowing, and what kind of startups are breaking through the noise right now. Let’s dive into what might’ve slipped under the radar—but shouldn’t.

#234 What Just Happened in VC? A Look at Q1 2025 (NVCA Venture Monitor)

Another quarter down, and it’s safe to say U.S. venture is still finding its footing. Q1 2025 wasn’t short on headlines—between massive AI mega-rounds and a sluggish fundraising climate, the vibe is... mixed. Some things feel eerily familiar (AI is still the darling), while others signal a shift (tariffs, cautious LPs, a venture debt tilt).

#233 Inside VC in Q1’25: Record Funding, Deal Flow, and What’s Next

So… what’s going on in VC right now? Honestly, a lot! Q1'25 kicked off the year with a bang—record-breaking funding, AI continued takeover, and some M&A activity (finally!). But the vibe on the ground is more nuanced: fewer deals are getting done, and founders are facing steeper expectations.

#232 April Markets Up/Down/All Around

It’s been a wild past week in the public markets. Even though we’re focused on private markets and venture capital here, what happens in the public markets will always have an impact across asset classes. Lower volatility markets (what we had before last Thursday) makes it easier to raise venture capital dollars, plan new investments, and exit businesses. When volatility increases (where we are now), a lot of that hits the pause button.

#231 Valuation Playbook 2025: Trends, Techniques, and Policy Updates

Today we’re diving deeper into valuation policies—specifically, how they’re applied in real scenarios and what adjustments funds are making in 2025. We expect a few notable trends and challenges! Market Volatility and Stale Marks are some current dynamics VC funds have to deal with.

#230 VC Quarterly Valuation Time (Q1'25)

Welcome to Q2! And cheers to all of those that celebrate April Fools’ Day! For VC CFOs / Finance Pros and GPs, April 1st means it’s time for quarterly reporting and valuations again! This should be light given all the work that went in to your Q4 reporting. That said, we revisit this each quarter as we go back to the basics.

#229 VC Co. Cap Tables, Exit Waterfall Models

We’ve been thinking a lot about waterfalls! Today we go deeper on VC company capitalization (cap) tables and exit waterfalls to understand how different investors in a company receive their proceeds in the event of an exit.

#228 VC Fund Waterfall Models, Simplified

What is a VC Fund Waterfall and why does it matter? Today we’re going to try and simplify a concept every VC fund manager and LP needs to understand - VC fund waterfalls! As always, the details matter, but we’ll try to keep it high level to start and have some fun along the way!

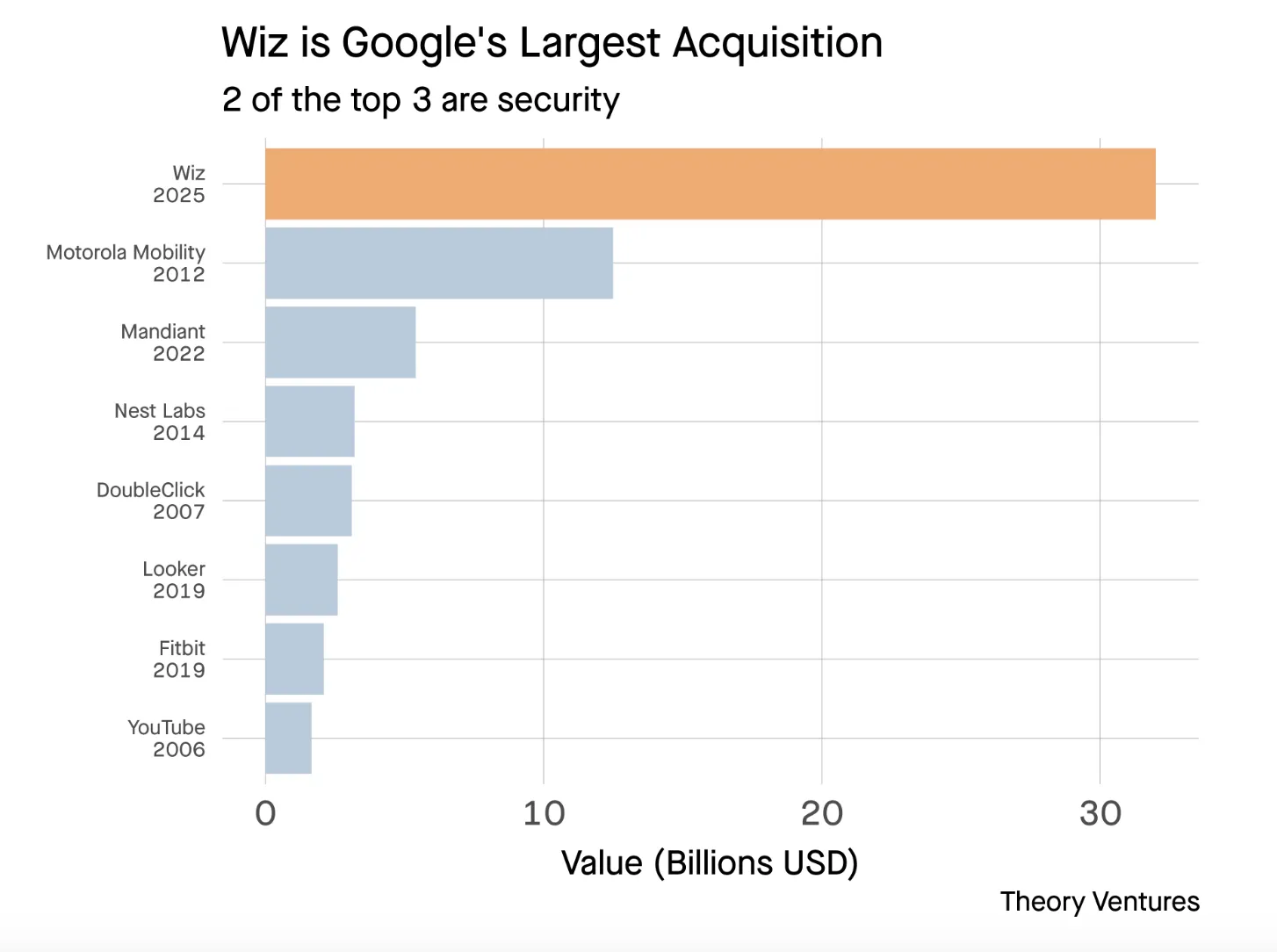

#227 Google/Wiz @ $32B & VC DPI - Floodgates Open?!

Is tech M&A back? Google announced its intention to buy Wiz for $32b earlier this week. If approved by regulators, it would be the 6th largest technology M&A ever. Wiz is a leading cloud security platform headquartered in New York. Once closed, Wiz will join Google Cloud.

#226 VC DPI, Liquidity 2025 (Real Case Study)

In the ever-evolving venture capital landscape, liquidity remains one of the biggest challenges for firms and their LPs. With the VC market experiencing a prolonged liquidity crunch, we discuss solutions to return capital to LPs without disrupting their portfolio companies or losing control over investment decisions.

#225 TrueBridge State of VC Deep Dive

Every year TrueBridge does a deep dive on the venture industry to identify key takeaways from the last year, highlight the most significant trends, and prepare for what is to come. Here is a link to their PDF: State of Venture Capital Industry. Let’s take a deep dive in their analysis of the challenges 2024 presented and where we could be headed in 2025.

#224 More VC Fund Tax & QSBS Detail!

In our previous post, we talked about QSBS, showed a theoretical example, and listed some common pitfalls. Now, let’s take a deeper dive into the practical steps investors, founders, and employees can take to ensure they capture the full benefits of QSBS.

#223 Small Teams Are The Future & VC Impact

One chart says it all (credit to Ben Lang on X). What does it mean for PE/VC? We’ll dig deeper below, but everyone should be asking - can we do more w/ less? That’s what the competition is doing…

#222 Bain Private Equity Report Unpacked

Bain & Company released its “Global Private Equity Report 2025” (PDF download link that’s hard to find)! This report is an annual analysis of trends, challenges, and opportunities in the PE industry (which also includes VC). It provides insights into dealmaking, fundraising, portfolio management, and emerging strategies that will shape the industry in the coming year.

#221 LA VC Week Recap, Top Funds, LP Insights

As we shared earlier this week, the VC world (along with LPs, founders) descended upon Los Angeles this week. Sequoia partner Pat Grady told the audience that, when it comes to VC as a whole, he’s a “short-term pessimist, long-term optimist.” Is VC back?! We lean towards the indicators for optimism in 2025 - we’ll see!

#220 Product Market Fit Summit in LA (Chapter One VC)

Yesterday, Chapter One hosted the Product Market Fit Summit in LA, bringing together top builders and investors driving breakthroughs in product development, engineering, and design. It was a fun event with 100+ attendees in sunny Santa Monica. The event featured a number of fun speakers w/ spicy takes

#219 Size Matters in VC (Cont'd) & DPI / Premium Carry Templates

We get asked a lot about different carried interest scenarios by LPs, GPs, and CFOs / Finance Pros. We get the question enough that we decided to share our own scenario analysis for DPI and waterfall calculations at 20%, 25%, and 30%+ carried interest scenarios. Teasing here with a visual and more on that below!

#218 Size Matters: Small vs. Big VC Funds (5x+ vs. 2x+), Lightspeed Returns Detail

Sheel Mohnot recently highlighted a key challenge for large VC funds: even with breakout hits, it's difficult to return more than 3x on a large fund. While firms like Lightspeed generate substantial absolute returns, smaller funds often achieve higher multiples. This aligns with insights from our previous post, where we analyzed how small VC funds can deliver outsized returns despite higher volatility (more below).

#217 VC Top Insights, Unpacked

"In just two years, more unicorns were created than in the entire previous decade. But the problem wasn’t just the quantity—it was the quality. The number of truly transformational startups didn’t increase. Capital just kept flowing, artificially inflating valuations and expectations.”

#216 VC Seed to Series A, $100m+ ARR, & More

Traditionally, VCs expect this transition to occur within 18-24 months. In what was once considered a "normal" year, such as 2018, 25-30% of startups that raised seed funding would successfully secure their Series A within 24 months or less. Today, not so much…

#215 VC Fund Taxes Simplified & QSBS

For VC GPs, CFOs & Finance Pros, fund taxes & QSBS matter! Doing it right can save millions of dollars! Doing it wrong can cost you your job. Below, we break down key concepts, insights, and pitfalls on VC Tax & QSBS. Enjoy!

#214 TheFundCFO January 2025 Recap

January 2025 is done, it’s time to reflect on the key insights and discussions shared throughout the month. We covered key topics on venture capital, market trends, data themes, and investment strategies. Here’s a quick rundown of the insights shared.

#213 State of VC & Impact on DPI / Fund Models

AngelList recently released its “The State of Venture 2024” report. It provides a detailed look into venture performance throughout 2024, providing actionable data and analysis for VC GPs, LPs, and founders. Our friend Chris Harvey shared his five key takeaways.

#212 Data Themes in 2025 & VC / Markets Impact

Today we’re diving into data themes for 2025 & their impact on venture capital / markets. Tomasz Tunguz's Top Themes in Data In 2025 include 1. The Great Consolidation, 2. Scale-Up Architectures, and 3. Agentic Data. We also discuss AI Transformation in 2025: What to Expect.

#211 VC Math & Top Recent Takes (TRT)

Happy Thursday folks! Today we’re back with some more VC math and hot takes from the week. Below, we share insights on the following posts and more: VC Math Behind Venture Capital 15%-20%+ Target Returns What to Expect from VCs if the Downturn Persists (Ali Afridi @ Equal) Venture Capital Unbundled (Kyle Harrison) Lazard 2024 Secondary Market Report: AI-focused startups attracted significant investments

#210 VC Monitor Report Deep Dive (Q4'24)

Ever quarter, we highly recommend reading the PitchBook-NVCA Venture Monitor. In the report, they provide great market data on what’s going on in VC. Lots of highly valued companies, few exits. 2024 IPOs performed well in public markets. Dealmaking remains slow but shows promising signs for 2025. Outsized deals continue to elevate total deal value. Q4 notches 2024 high for early-stage deal count. Despite Q4 increase, late-stage deal activity declines for third consecutive year.

#209 Why Invest in Venture Capital? Making A Simple Case for FAs / RIAs

Why Invest in Venture Capital? 20% Net. Simply put, to invest in venture capital, you should believe there is a path to 15%-20% annual returns, or a >5% premium to public markets. Good news: studies show that this can be done if you pick your investments well!

#208 VC Cash Runways and Burn Rates - Metrics That Matter

Hope everyone is enjoying audit season! 🙂 It’s the time of year where finance folks talk a lot about cash runways and burn rates (how much you spend each month). For venture capital auditors and finance professionals, these are a few of the metrics that really matter!

#207 Q4 Valuations & Valuation Policy Updates (w/ Real Examples)

Do You Need a Valuation Policy? Answer: Yes 🙂 Valuation policies play a critical role in venture capital fund management. They establish a consistent framework for assessing the fair value of your portfolio companies, which is essential for transparent investor reporting, regulatory compliance, and strategic decision-making.

#206 Big 2025 Predictions & Venture Banks

We’re back - excited for a big year! What happened last year that we got right / wrong?! Where are things going in the year that lies ahead?! While I have plenty of thoughts (and will share them), I thought it’d be fun to highlight some of my favorite year-end retros looking back and big predictions (or provocations) looking forward to reference as you kick off the new year.

#205 Best of 2024 & Top Premium Content (Organized)

This is our last post of 2024 - thanks for another great year! Venture capital investments are (hopefully) back and we will see what all things technology (AI) has in store for us in 2025! In the meantime, fund models, budgets, compliance, and general finance / operations still matter!

#204 Top 10 CFO Posts of 2024

As 2024 comes to a close, we’re taking a moment to reflect on the most impactful and engaging content shared throughout the year. This list is based on your views, and engagement—your favorites, distilled into one ultimate lineup. Dive in and explore the top 10 CFO posts that shaped the conversation this year!

#203 VC Fund Model: DPI Forecast Template

Today, we share more on what DPI really looks (from a real example) including the mechanics for fees & expenses, called capital, carried interest, recycling, and other key components.Today, we share more on what DPI really looks (from a real example) including the mechanics for fees & expenses, called capital, carried interest, recycling, and other key components.

#202 VC Fund Math Revisited

What game are you playing in VC? Established VC funds with large AUM can lower their return targets to 3x+. I would argue (and believe most LPs would agree) that most early-stage emerging managers need to be shooting for 10x+ funds. But how do you do that?

#201 VC News, YC, & The Future of Venture Capital

Big wins can still come if you’re investing later in the game at multibillion dollar valuations. None of these big wins were a sure thing, even a year ago. However, big losses are still on the table as well!

#200 VC Investment Up, Year-End PE/VC Prep

To kick off December, we thought we’d share and break down a few charts from Peter Walker at Carta. We’ve seen a lot of different frameworks over the years to keep track of all the requirements for funds at year-end. Here’s some of the top items in each bucket for year-end…

#199 Top Posts of Q4 (Through Nov)

Happy Thanksgiving week! This week, we’re keeping it short and sweet, sharing our top posts of Q4 through November. These were the top posts by views - readers were sharing these! Hope the links and the summaries are helpful. We’ll be back with more detail next week!

#198 Ultimate PE/VC Fund Checklist for Year-End Finance & Compliance

In November/December (and January), the number one topic of conversation is year-end items (and checklists to back them up). That made us think - what if we put this all in one place, in one checklist ultimate that you could actually print and check off?!

#197 CLT, State of NC Pension & PE/VC

I attended Invest for Charlotte in Charlotte, NC, an investment conference benefiting the children and families of Charlotte. We heard from great speakers about their investment strategy in PE/VC & public equities. Here are some highlights from NC Treasurer-Elect Brad Briner's speech and full plan details.

#196 Q3 US VC Valuations Report Summary

Every quarter, Pitchbook releases their US VC Valuations Report. They have a number of reports and charts on their website that aggregate data on what’s going on across the VC landscape. Some quick takeaways here with pictures / charts

#195 Markets Go Up (& Post-Election Takes on VC)

On Tuesday, November 5th, 2024, an election happened in the USA. That has been covered ad nauseum and you can see the results in the headline pictures above. So now what?

#194 State of Venture, VC Incentives, & AI Scaling Insights

A recent BG2 podcast (Bill Gurley, Brad Gerstner) featured Jamin Ball (Clouded Judgement). This was one of the best commentaries I’ve heard in a while on a number of key topics. Here are some quick takeaways, summaries, and links to deeper insights / analysis...

#193 LPs Reconnect in NC: Morgan Creek, Academy, NC LP Landscape Map

Earlier this week, I was back in Raleigh-Durham, North Carolina to catch up with a number of PE/VC and broader private/public investors. The alumni club is pretty impressive and it was fun to see where folks are building / investing.

#192 What Makes The Best VCs The Best?

“The best VC funds are contrarian with conviction.” Contrarian: opposing or rejecting popular opinion; going against current practice. Conviction: a firmly held belief or opinion. In VC, it means investing “a meaningful amount” relative to your fund size.

#191 Top VC Reads & CFO Takes This Week

VC investors have already been washed out with total number of investors dropping below 2014 levels. Will 2025 be the best venture fund vintage of all time?! Arguably, there is more upside than ever before…

#190 VC Exits Take Time - Will LPs Wait?

The TLDR is that big exits take time in VC. My question in response right now - will LPs wait? Time will tell if LPs are willing to continue to wait with emerging managers. The data says that with some, yes, but with many others, know. We will see!

#189 VC Monitor Report Deep Dive (Q3'24) & Exit Predictions (DPI)

Every quarter, we highly recommend reading the PitchBook-NVCA Venture Monitor. From there, we can take that data and make some predictions about the future! We pulled out the best insights so you don’t have to. We’ll also share takeaways and predictions.

#188 VC Headlines of The Week (So Far)

We’re trying something new this week - sharing some of our top headlines and takes on what they mean for VC. We hope you find them helpful - enjoy!

#187 VC Fund Launch Unpacked! Insights from VCs & CFOs

“Launching a VC fund isn’t as simple as it seems.” If you’re an emerging manager, this is a must-read for insights into avoiding costly bottlenecks and building a sustainable venture.

#186 VC Market Update (Q3 Data)

Hello everyone! We put a bow on Q3 last week and are starting to digest what happened and where the market is going. We will share more on this as we dig in deeper this quarter.

#185 Starting a VC Fund - Playbook Insights

We’ve spent thousands of hours investing in and building funds. We like to think we’ve learned a lot along the way and want to share a few of our own insights and framework on what we thought about these things.

#183 VCs Closing Q3: Expert Mode w/ Our CFO Checklist

Our year-end process can easily be applied to the end of Q2. We’ve seen a lot of different frameworks over the years to keep track of all the requirements for funds at year-end. One of our favorites is breaking things down into four buckets: portfolio companies, investor reporting, compliance/legal, and operations/HR.

#182 VCs Closing Q3 w/ Playbook, Model, Valuation Updates

Happy last week of Q3 - time to close it out! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?!

#181 My VC "Rule of 50", Ownership, Fund Model Impacts

My own "Rule of 50". Quick math on "Rule of 50": A) VC fund wants to 3x B) On avg, assume a fund owns 10% at entry but only 6% at exit exit (dilution)! C) Multiply fund size by 50 and that's the total exit value fund needs to 3x

#180 VC Q4 Planning & Capital Call Template

We’re approaching the end of the quarter again - that means it’s time to start planning ahead for Q4! There are a number of different pieces that go into a capital call forecast. Good news, we’ve seen almost all of them!

#179 VC PortCo Mortality Rates

Earlier this week I was meeting with a longtime friend and LP in venture capital. He asked the following question: what is your portfolio company survival rate and how does it compare to others in the industry?

#178 VC Fund Models (Reserves Matter)!

I would argue (and believe most LPs would agree) that most early-stage emerging managers need to be shooting for 10x+ funds. But how do you do that?

#177 Top VC CFO Premium Content (Summer 2024)

For this edition, we’re sharing some of our top VC CFO premium content from summer 2024. We hope you enjoy it!

#176 The End of VC Summer - Top Reads

For this edition, we thought we’d share some top reads as we set the foundation for fall. Enjoy!

#175 VC DPI in Yr 5 - What Does It Mean?

David Clark at VenCap started a conversation on DPI.

#174 VC Data - Top Takes On H1 2024

“Over 40% of 2018-vintage VC funds have not made a single distribution.” - Dan Primack

#173 VC Market Insights (Mid-August)

Top takeaways: Fundraising grew from $18.7b (Q1) to $20.9b (Q2) across US startups

#172 August VC Fund Stats

Since we’re back from the beach, we thought it would be a good time to share some of our favorite VC fund stats from recent readings.

#171 July Roundup: Top VC CFO Content

July Roundup: Top VC CFO Content Happy Thursday folks! We’re pulling together top VC CFO content we dove into during the month of July - we hope you enjoy! We’ll be off next week at the beach but excited to catch up more when we’re back!

#170 VC CFO Insights - All Visuals

A Picture is Worth 1,000 Words, Right? Happy Tuesday folks! Today we’re going to try something a little bit different - we’re going all visuals! Our bet is that you’re going to love getting your VC CFO insights in picture and chart format this week. Words are great but a picture is worth a lot of words! Let us know what you think - in the meantime, enjoy!

#169 VC Market Update (Q2'24) & Exit Predictions (DPI)

Highlights: PitchBook-NVCA Venture Monitor (Q2 2024) Every quarter, we highly recommend reading the PitchBook-NVCA Venture Monitor. In the report, they provide great market data on what’s going on in VC. From there, we can take that data and make some predictions about the future! Here are some of our favorite highlights from the 50-page report (we pulled out the best insights so you don’t have to). We’ll also share takeaways and predictions.

#168 VC Velocity Up?! Stripe, Wiz Exits...

VC Has a Liquidity Problem - Can Stripe/Wiz Fix It?

#167 How This Ends (Fred Wilson & More)

Discussion on Fred Wilson and the venture capital sector

#166 "Best Advice for an Emerging VC?"

This week, we are pulling out one of our most popular posts from last summer with a few updates. Here we go!

#165 Q2 PE/VC Valuation Policies & Templates (Download)

VC Valuations at Q2 Hello friends! It’s quarterly valuation time again! We did a deep dive on this at the end of Q4 and are bringing back a lot of this analysis and insight.

#164 AI is Driving the VC Market

The Dog Days of Summer & Kicking Off H2’24. It’s a prime opportunity to recharge and realign our strategies for H2’24. Kicking off the second half of the year with a clear plan is crucial. Here are a few strategies we’re focusing on:

#163 Top 7 VC CFO Posts of H1 2024

These are the top 7 posts by engagement for the first half of 2024. Reflecting on them, the most popular had some sort of tool, playbook, or template. Readers want actionable content that makes their lives easier - noted!

#162 VCs Closing Q2 w/ Playbook, Model, Valuation Updates

The Quarterly Closeout Happy last week of Q2 - time to close it out! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?! Revisiting The Year-End CFO/Finance Checklists at Q2 Our year-end process can easily be applied to the end of Q2. We’ve seen a lot of different frameworks over the years to keep track of all the requirements for funds at year-end. One of our favorites is breaking things down into four buckets: portfolio companies, investor reporting, compliance/legal, and operations/HR. Here’s some of the top items in each bucket for year-end…

#161 The 2024 VC Vintage & Power Law - Time to Invest?

“When the going gets tough, the tough keep allocating” “Is now a good time to allocate to VC?” That’s a common questions LPs are asking GPs these days. Today, we dive into a recent report from Stepstone that examines what returns looked like for VC investors in various vintage years. “We believe 2024 very well could be a power law vintage.” Read more here (full report linked below): “In VC, we often observe two behavioral phenomena hindering successful outcomes that are closely linked: recency bias and the fear of missing out. Quite simply, investors tend to allocate more heavily to the asset class during periods in which recent performance has been strongest. Concerns over not capturing upside when the stars seem to be aligned can further exacerbate aggressive investing at market peaks.”

#160 VC Fund Math: "Maximum Convexity" Leads to 10x+ Funds

VC Fund Math: "Maximum Convexity" = 10x+ Funds What game are you playing in VC? Are you going for 10x+ funds or 3x+ funds? Established VC funds with large AUM can lower their return targets to 3x+. A $1b fund generating a 3x = $3b of returns, $2b of profits. That’s at least $400m of carry for the team at 20%. Not bad. I would argue (and believe most LPs would agree) that most early-stage emerging managers need to be shooting for 10x+ funds. But how do you do that? Today, we share insights from Roger Ehrenberg (Eberg Capital, formerly IA Ventures). Roger shares the following (linked here): “As I've written on numerous occasions, markets, portfolios and, in fact, many systems in life take the shape of barbells.”

#159 VC CFO Q3 Capital Call Template (Free)

VC CFO Q3 Capital Call Template We’re approaching the end of the quarter again - that means it’s time to start planning ahead for Q3 and the second half of the year! Most VC funds call capital from LPs at the end of each quarter, so later this week. LP’s often appreciate a regular capital call cadence so that they can plan cash flow. There are a number of different pieces that go into a capital call forecast. Good news, we’ve seen almost all of them! Here’s a link to a simple capital call template you can use for Q3, pictured below. Enjoy!

#158 VC Breakout Companies (Ch.1) - What Does it Take?

Venture Capital Insights - YTD 2024 We’ve made it to Memorial Day Breakout Company Founders: Highlights from Devin Wenig (Symbolic.ai) and Mike Silagadze (ether.fi) We talk a lot here about what it takes to build great VC funds and firms! The catch is, none of it matters if you aren’t accessing and investing in founders that can build breakout companies! Today, we share some insights from two of those founders. In a recent Chapter One ‘Breakout Companies’ call, we had the privilege of conversing with two industry leaders: Devin Wenig, co-founder and CEO of Symbolic.ai, and Mike Silagadze, co-founder and CEO of ether.fi. Here are the key takeaways from the discussions.

#157 VC Fund Budgets & Models, Unpacked

Fund Budgeting and Portfolio Construction (Vector) We’ve been really impressed with recent thought leadership pieces from Vector. Here are some of our favorite takes on fund budgeting and portfolio construction: “Effective fund management requires an understanding of the various expenses involved. Fund expenses and management company expenses are two primary categories that every fund manager must plan for over the lifetime of the vehicle. Fund expenses are typically borne by the fund/investors and these expenses are paid directly from the fund’s assets. Management fees, paid by investors as a part of their capital commitment to the fund, are typically a percentage of the committed capital (or invested capital, though generally that strategy is less common in VC and utilized in the latter half of a fund’s life) and are paid to the fund managers.

#156 Top VC CFO Insights of May 2024

Key Themes at Allocate Summit From GPs & LPs (Samir Kaji) AI App Layer Wins. Most believe that LLMs are not where investments return will be had, but rather much more excitement for the app layer. Feeling is LLMs will be commoditized, and large incumbents will be the winners. Sentiment: Optimism for tech is sky-high, but investment sentiment is still tempered given the AI hype & continued deterioration of portfolios that were propped up during the ZIRP period. Liquidity: Everyone agreed liquidity market is broken. IPOs are now reserved for companies that have $200MM-$300MM+ in revs and large cap M&A is really tough given regulatory environment. Lots of discussion about continuation funds, PE led acquisition ($500MM-$2B).

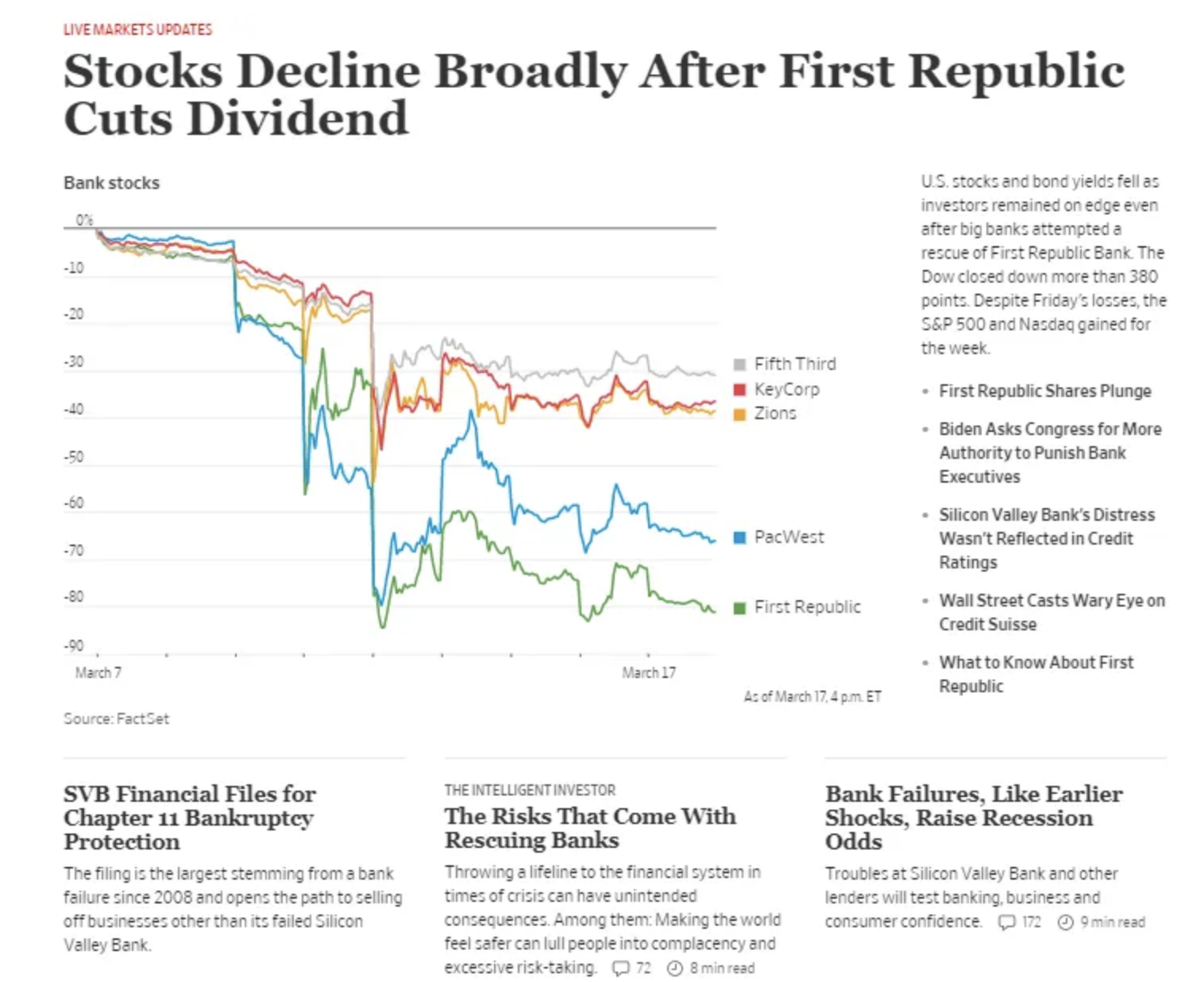

#155 Venture Insights & Small VC Fund Outperformance

Venture Capital Insights - YTD 2024 We’ve made it to Memorial Day Weekend 2024 - congrats! We’ve been inspired recently by a number of insights and wanted to share some highlights here: Aumni Venture Beacon Year End 2023 Report: The prevailing narrative since the end of 2021 has been one of stress feeding through venture markets owing to a combination of a higher rates environment, banking market volatility, and subdued IPO markets. Median post-money valuations fell ~50% from 2022 to 2023. These developments were accompanied by steady increases in the prevalence of down rounds through last year.

#154 VC Fund Math: The Path to 10x+

“Making 10X in Venture is complicated…” A recent X post from Martin Tobias on VC fund math inspired us while also reminded us that VC is hard! You have to worry about things like dilution, protecting your ownership, etc. to hit a 10x return on just one investment. Then to have a great fund, you really need a 100x fund driver. That’s hard to get! We’ve written about this topic extensively (more below). In the meantime, we’ll pass the mic to Martin to share more on his 15.6x mark-up that was really a 5.5x after accounting for dilution (spreadsheet linked in thread): “Making 10X in Venture is more complicated than most people think. I recently invested in a $16M post, and the company just raised a $250M post. Up 15.6X? No, only up 5.5X. Here is the math. For early investors to make 10X, the valuation has to be over 40X higher than our entry price. It is much harder for VCs to get outlier returns than most understand.”

#153 VC Fund Audit Retro: Insights for Mid-Year Financials & 2024 Audit

Recently VC CFOs/Finance Pros and fund managers emerged from the depths of audit and tax season (that wrapped up end of April). Each year, VC funds are required to do an audit, where a third-party comes in and reviews all your financial reporting and accounting from the prior year to confirm it’s accurate. This is required for most funds out there and necessary for accurate tax reporting / payment.

#152 VC Across America (LA, SF, NY, DC)

Top CFO Takes for VCs/LPs From LA, SF, NY, DC Los Angeles: Milken Week (May 5th-8th) Tracks AI, Innovation, & Technology Financial Markets; Health & Medical Research; Human Capital, Jobs, & Education; Policy, Politics, & Regulation; Security & Risk; Sustainability & Environment

#151 Top CFO Takes for VC GPs & LPs

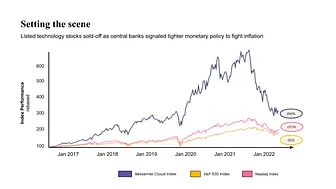

Top CFO Takes for VC GPs & LPs Revenue multiples matter! It’s wild to look back at peak EV/NTM revenue multiples in late 2021. The top companies peaked at 62.5x! Applying that math to private companies, if you had $16m of revenue forecasted (and investors believed it), you were worth $1 billion (unicorn)! Today, things have come back to reality. Most companies are lucky to get a 10x multiple. That means you have to build a $100m revenue business to be worth $1 billion in the public markets. Times have changed!

#150 Primack's Letter To VCs & CFO Takes

Letter to VCs (Dan Primack) & CFO Takes Earlier today, Dan Primack shared a letter to VCs that you can read here. Dan is known for his daily newsletter and often spicy takes on VC. The letter does capture a lot of what VCs and LPs are talking about in today’s market environment. While I don’t agree w/ all of it, here are some of my favorite takes: The basic VC model is cyclical. Raise money, invest that money, exit via IPOs or strategic sales, and then use those exits to raise more money. But it doesn't work if you stop exiting companies. A whopping 37% of "unicorns" are being held for at least nine years by VC funds, including 13% that are past the 12-year mark LPs need to believe they’ll see distributions within a certain timeframe. The VCs that can balance distributions with holding their winners will gain credibility with LPs and thrive going forward.

Paid Newsletter- #149 VC Fundraising in 2024 - Execute!

Top VC Fundraising Reads & Lessons (Timeless) Previously, we shared posts with lessons learned from VCs such as Fred Wilson @ Union Square Ventures, Jeff Morris Jr. @ Chapter One, Elizabeth Yin @ The Hustle Fund, Winter Mead @ Oper8r, and Mark Suster @ Upfront Ventures. All have had different fundraise journeys and share unique insights. The background posts are linked here: #134 VC Investor Relations, LP Communication Best Practices #94 VC Fundraising Basics & Bear Market Strategies #30 VC Fundraising in 2023 #21 VC Fundraising 101: Track Record & Data Room #9 Opportunity Fund Insights #8 Fundraising - Show Me the Money!

#148 a16z Closes $7B: What It Means Emerging VC Managers & LPs

a16z closes $7.2 billion → what does it mean for emerging managers (“venture alpha”)? As reported by Axios, Andreessen Horowitz (a16z) has closed on $7.2 billion for its newest set of funds. CFO take: a16z raises capital from large investors looking to access venture capital and is a barometer for how LPs feel about the asset class. Many LPs take a “barbell approach” to venture capital. They invest in large fund vehicles like a16z to get “venture beta” (2x-3x target returns). The other side of the barbell is “venture alpha” (5x+ target returns), often represented by emerging managers.

#147 Navigating the VC Landscape in 2024

Outperformance & Fundraise Insights from Cendana & Sapphire Navigating VC Landscape in 2024 - What’s Going On? PitchBook-NVCA Venture Monitor (Q1 2024) Law of VC: #32 Episode - YC's Secret SAFE (Chris Harvey) In the Q1’24, the US VC stayed slow but is maybe finding a bottom?! Key stats: $36.6 billion invested across 3,925 deals, remaining steady compared to previous years $300 billion in dry powder available Defensive investment climate, where investors are focusing on existing portfolios rather than new ventures Insider-led rounds are prevalent, while first-time financings are at multiyear lows.

#146 Best CFO Reads for VC GPs & LPs

Top Reads of Recent History, VC CFO Style #142 VC Market Maps & Useful Data #141 VC is the Best (Asset Class) if You Choose Wisely #140 RTF (Return The Fund) Math for VCs #137 The Ides of March -> VC CFO Deadlines #135 Regulatory for VC Funds, CFO Edition #130 Top Takes of 2024 (So Far) & Takeaways #123 Q4 Valuations + Real Policy Examples (Download) #119 The Ultimate PE/VC Fund Checklist for Year-End Finance & Compliance A Crowdsourced List of Books and Resources for New Venture Capitalists

#145 Best CFO Reads for VCs / LPs

The Case for 30+ Co.'s Per VC Fund Best Recent Reads We’ve Seen on the Web Sourcery → YC W24, SBF, WeBack ? (Molly O’Shea) Data-Driven VC: Zero to 30M ARR Playbook, Pros & Cons of Venture Debt, State of Liq Prefs, Growth Hurdles & More Sarah Tavel (Benchmark): What MidJourney, DeepL, ElevenLabs, and HeyGen have in common (besides special teams and explosive growth!) Confluence.VC: GGV Splits (Clay Norris)

#98 Emerging VC Outperformance: Insights & New Capital From Cendana, Sapphire

Outperformance & Fundraise Insights from Cendana & Sapphire The right emerging VC managers can drive real outperformance in investment portfolios and will continue to do so for decades to come. Every manager in the market today was emerging at one point, and behemoths like a16z just ~15 years ago. While we find ourselves in a slower VC fundraising environment today, capital allocators are still investing in emerging managers.

Paid Newsletter- #97 Sequoia's Strength In Numbers (Insights from The Power Law Book)

Sequoia's Strength In Numbers (Ch.13 in The Power Law) The book highlights notable moments in the history of venture capital, culminating in an analysis of one of the most successful venture capital firms, Sequoia Capital, in one of the final chapters that spans more than 10% of the book.

#96 The Case for 30+ Co.'s Per VC Fund

The Case for 30+ Co.'s Per VC Fund Portfolio construction is a hot topic for VC funds and LP investors. Before investing, almost every LP will ask a VC: what is your portfolio construction strategy? There’s a lot of data, conventional wisdom, and strong thoughts on this. Some say concentrate. Others say diversify. What’s the right approach for the average VC fund?

Paid Newsletter- #95 VC Deep Dive: Footwork + 20VC

There’s a lot of great content from notable VCs, LPs, and CFOs/finance pros on the internet. Here, we’re focused on pulling out the insights out that really matter, as well as finding the most current content that overlays historical lessons with current market dynamics, which are changing faster than ever. Today, we’ll share some insights from the recent conversation with Nikhil Basu Trivedi (Footwork) and Harry Stebbings (20VC).

#94 VC Fundraising Basics & Bear Market Strategies

VC Fundraising Recap & The Basics We’ve seen a lot of different VC fundraising markets in the last 15 years! Previously, we shared posts with lessons learned from VCs such as Fred Wilson @ Union Square Ventures, Jeff Morris Jr. @ Chapter One, Elizabeth Yin @ The Hustle Fund, Winter Mead @ Oper8r, and Mark Suster @ Upfront Ventures.

Top VC CFO Posts of Summer (June/July/Aug)

Top 5 Posts by Engagement in Summer (June/July/August) We’ve aggregated our top five posts from June/July/August - these ones really resonated with thousands of views, shares, and feedback! Please do us a favor and like/share if you haven’t already. In the meantime, enjoy!

#93 VC DPI & Power Laws - What They Mean Today

VC Deep Dive Recaps - August Dear readers, thanks for all the great feedback on our August VC deep dives! We’ve gone deep on some notable VCs & unpacked some insights around building generational firms (#91 VC Deep Dive: Fresh Takes From Top VCs, #89 Brad Gurley (Benchmark) + David Sacks (Craft), & #87 Building Generational Firms). “Now more than ever, VC firms need to think strategically about their business model.”

#92 VC Reg & Legal Change - The Updates

VC Regulatory & Legal Change - The Updates Last week, we wrote about regulatory and legal impacts on VC funds and funds of all types (#90 VC Regulatory & Legal Change Coming). We flagged insights from one of our favorite legal and regulatory experts, Chris Harvey.

Paid Newsletter- #91 VC Deep Dive: Fresh Takes From Top VCs

VC Deep Dive: Fresh Takes From Top VCs Dear readers, thanks for all the great feedback on our recent VC deep dive posts! We’ve gone deep on some notable VCs & unpacked some insights around building generational firms (#89 VC Deep Dive: Brad Gurley (Benchmark) + David Sacks (Craft) & #87 VC Deep Dives & Building Generational Firms). “Now more than ever, VC firms need to think strategically about their business model.”

#90 VC Regulatory & Legal Change Coming

VC Regulatory & Legal Change Coming Previously, we’ve written about regulatory and legal impacts on VC funds and funds of all types, private and public. It’s important for any VC CFO/finance pro or GP to know enough regulatory and legal to make sure they’re operating in a compliant and thoughtful manner as they grow their funds and firms.

Paid Newsletter- #89 VC Deep Dive: Brad Gurley (Benchmark) + David Sacks (Craft)

VC Deep Dives & Building Generational Firms - Reflections Last week, we dove deep on some notable VCs & unpacked some insights around building generational firms from said VCs (#87 VC Deep Dives & Building Generational Firms). We wrote that “now more than ever, venture capital firms need to think strategically about their business model.”

#88 Latest CFO Takes on the State of VC

State of Private Markets in Q2’23 Venture capital firms and industry providers have reported Q2’23 valuations and portfolio updates at this point. Pitchbook released the Q2’23 Venture Monitor. CB Insights shared the State of Venture Q2’23. Carta released the State of Private Markets: Q2 2023 report

Paid Newsletter- #87 VC Deep Dives & Building Generational Firms

Building Generational VC Firms - What Does It Take? Venture capital firms are re-assessing their position, processes, and investments in 2023. This includes the generational VC firms (ones that have been around >10 years and have had a lot of success) like a16z, First Round, Founders Fund, Kleiner Perkins, Lightspeed, Sequoia, Union Square Ventures, etc.

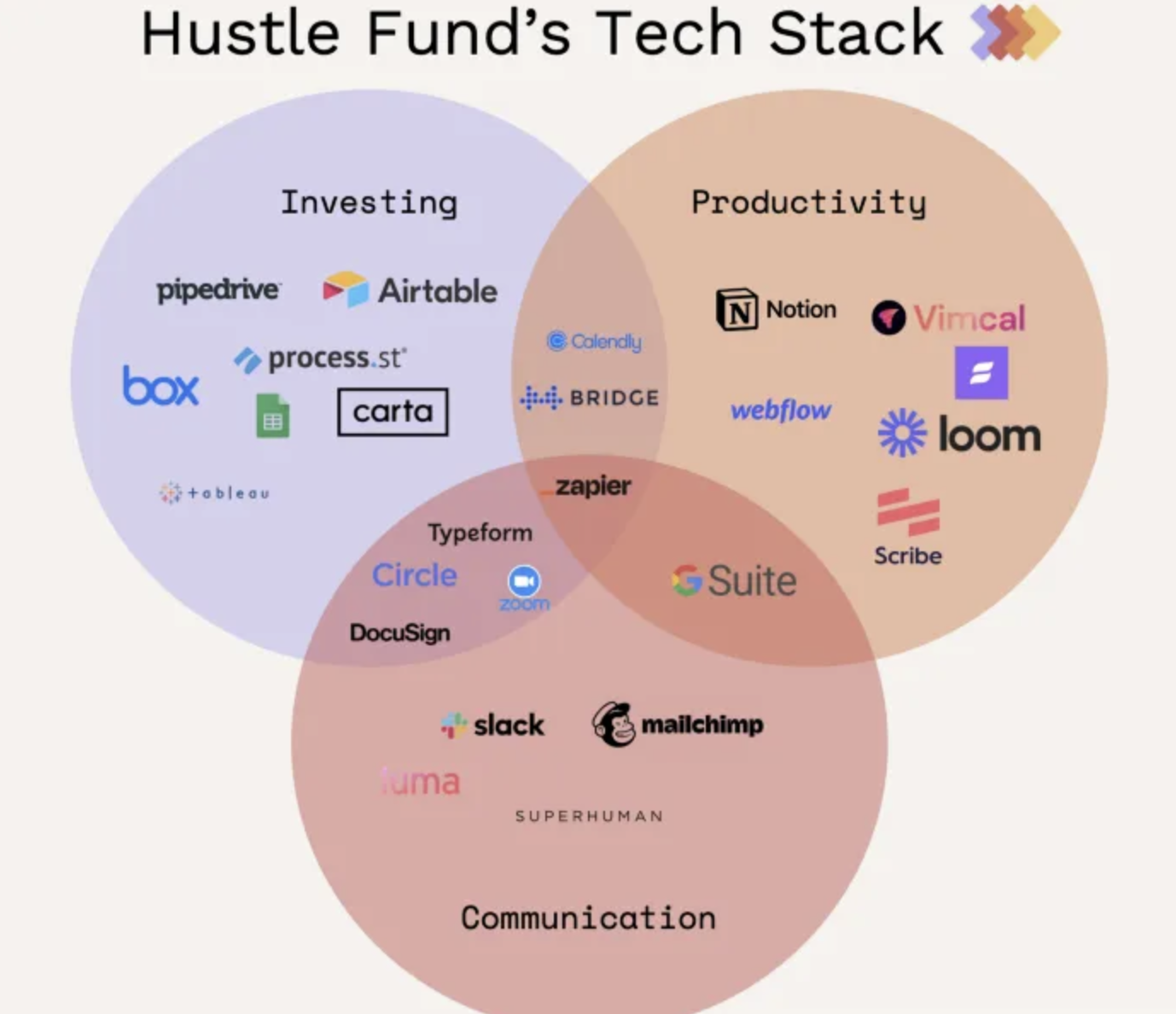

#86 VC Fund Stacks Are Back!

Emerging VC Fund Tech, Data & Efficiency Stacks “Emerging VC back-office complexity is a hell of a thing. The problem for most new managers is that there is an absence of what 'good' looks like when selecting fund admin, tax, and audit partners.” -Eric Bahn, The Hustle Fund

#85 VC Valuation Headlines & Policies

VC Valuation Headlines & Policies As Q2 VC valuation headlines start to come out, this is a good time to revisit your valuation policies and make sure they provide the right foundation for investor reporting. The latest headline on valuations was from Business Insider yesterday:

Top VC CFO Posts of June/July

Top 3 Posts by Engagement in June/July We’ve aggregated our top three posts from June/July - these ones really resonated with thousands of views, shares, and feedback! Please do us a favor and like/share if you haven’t already. In the meantime, enjoy!

#84 Differentiate w/ Data in VC

"If Everyone Has the Same Data, How Can You Even Differentiate?" This is the question that Andre Retterath (Data-driven VC) asked in his most recent post. It’s a topic that is on the minds of a lot of LPs and GPs in venture capital in 2023, when data and technology tools to leverage it are becoming more available. Even if you’re using them, are you using them better than your competition?

#83 Q2 LP Updates - Best VC Insights from GPs & LPs

Q2 LP Updates - Best VC Insights from GPs & LPs If you’re a VC GP or CFO/Finance Pro, you’ve likely finalized (or are close to finalizing) your Q2 report and financials. At the end of each quarter, “The Playbook” requires VC funds to review and update their financial performance to investors. That means working with fund administrators / accountants to review portfolios and update company valuations based on your Valuation Policy.

#82 "Best Advice for an Emerging VC?"

What’s The Best Advice for an Emerging VC? Over the years, we’ve met with thousands of emerging VC managers and invested in / worked with hundreds. We’ve logged thousands of hours of research, reading, and listening to podcasts to pick the brains of some of the must successful VC and LP investors out there (who were all “emerging” at one point in time).

#81 Top VC Insights for Q3'23

Top VC Insights for Q3’23 Happy Tuesday folks - it feels good to be back writing! Today we’re sharing some of our top VC insights for Q3’23. We did a lot of holiday reading and have including our favorite insights, headlines, and articles as you kickoff the quarter. Enjoy!

#80 Closing Q2 w/ Playbooks, VC Fund Models, Budgets. +Q3/Q4 Outlook

The Quarterly Closeout Now it’s time to close Q2’23! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?! We looked back at our most impactful posts from Q2, which included the following:

#79 VC Insights in London, UK, Europe

Headlines Remind us London, Europe is a Big Deal for Venture Capital It’s been an exciting year thus far for London, the UK, and Europe more broadly. As increased regulation and scrutiny builds in the United States, we’ve seen a different approach to technology (including AI and web3) in London and Europe. Major VCs such as Sequoia and a16z have opened offices and made major investments. Here are some recent headlines that give context:

#78 "When Do I Hire a VC Fund CFO?" (vs. Controller, Fund Admin)?

“When Do I Hire a VC Fund CFO?” (vs. Controller, Fund Admin)? This is one of the most common questions we get as LP investors and VC CFOs for hundreds of funds over the past three decades (collectively w/ Eddie Duszlak). There’s no one right answer here! We think it’s best to simplify by asking yourself a question.

#77 VC CFO Q2 Review / Q3 Key Action Items

The Quarterly Closeout It’s June 15th and we’re two weeks away from closing out Q2’23! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?!

#76 VC Headlines Won't Stop, Inflation Down

VC Headlines Keep Coming - What You Need to Know & Pods for Travel So. Much. Action! VC headlines can’t stop won’t stop right now - so much for the summer slowdown! In the past week, we’ve seen some big news w/ big implications for VCs and LPs investing in some of the most notable technology sectors.

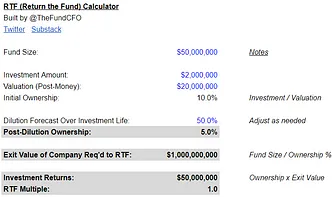

#75 VC Power Law & RTF Math (w/ Template)

How Venture Capital Really Works: Returns Are Driven by Power Law For years, we’ve been saying that every VC fund manager needs a fund model (portfolio construction and reserves). Why? A fund model provides a plan for investing, is often required by investors, and can drive outsized returns (and help avoid value-destroying mistakes)!

#74 Q1'23 Emerging Manager Report - Key Takeaways for VC

Our friends at Signature Block are back again with a new report! They collected 5,000 data points by surveying emerging managers in venture capital.

#73 Dealflow & What Really Matters in VC

We’ve been talking to a lot of LP investors and VC GPs lately about what really matters in VC. When you simplify what drives success (outsized returns) in venture capital, it boils down to a few simple concepts:

#72 What LP's Are Thinking About VC Right Now

Where is the world going and what does that mean for my investment portfolio? That is the general question all types of investors are asking right now! We’re reading headlines and digesting macroeconomic / industry data to understand what it all means for our various investment strategies.

#71 Data-Driven VC & Impact on Fund Finance

“VC’s are becoming more data-driven. More efficient. Supercharged by AI tools.” This is the common narrative today. But is it true? The reality is that most firms are trying. However, becoming more data-driven and efficient takes time and commitment to new tools, new processes, and execution.

#70 VC Platform (Founder Experience) & Hiring Insights

In our past posts @TheFundCFO Newsletter, we’ve covered a lot of ground, mostly related to fund finances, operations, and driving fund returns via models, budgets, technology, and processes. That’s good stuff but it’s definitely not everything! What we haven’t talked enough about is the portfolio companies and people that make all of that possible.

#69 VC Fund Audit Retro: Insights for 2023