Airstream Alpha Newsletter Archive

The latest Airstream Alpha news & articles below.

#98 Emerging VC Outperformance: Insights & New Capital From Cendana, Sapphire

Outperformance & Fundraise Insights from Cendana & Sapphire The right emerging VC managers can drive real outperformance in investment portfolios and will continue to do so for decades to come. Every manager in the market today was emerging at one point, and behemoths like a16z just ~15 years ago. While we find ourselves in a slower VC fundraising environment today, capital allocators are still investing in emerging managers.

Paid Newletter- #97 Sequoia's Strength In Numbers (Insights from The Power Law Book)

Sequoia's Strength In Numbers (Ch.13 in The Power Law) The book highlights notable moments in the history of venture capital, culminating in an analysis of one of the most successful venture capital firms, Sequoia Capital, in one of the final chapters that spans more than 10% of the book.

#96 The Case for 30+ Co.'s Per VC Fund

The Case for 30+ Co.'s Per VC Fund Portfolio construction is a hot topic for VC funds and LP investors. Before investing, almost every LP will ask a VC: what is your portfolio construction strategy? There’s a lot of data, conventional wisdom, and strong thoughts on this. Some say concentrate. Others say diversify. What’s the right approach for the average VC fund?

Paid Newletter- #95 VC Deep Dive: Footwork + 20VC

There’s a lot of great content from notable VCs, LPs, and CFOs/finance pros on the internet. Here, we’re focused on pulling out the insights out that really matter, as well as finding the most current content that overlays historical lessons with current market dynamics, which are changing faster than ever. Today, we’ll share some insights from the recent conversation with Nikhil Basu Trivedi (Footwork) and Harry Stebbings (20VC).

#94 VC Fundraising Basics & Bear Market Strategies

VC Fundraising Recap & The Basics We’ve seen a lot of different VC fundraising markets in the last 15 years! Previously, we shared posts with lessons learned from VCs such as Fred Wilson @ Union Square Ventures, Jeff Morris Jr. @ Chapter One, Elizabeth Yin @ The Hustle Fund, Winter Mead @ Oper8r, and Mark Suster @ Upfront Ventures.

Top VC CFO Posts of Summer (June/July/Aug)

Top 5 Posts by Engagement in Summer (June/July/August) We’ve aggregated our top five posts from June/July/August - these ones really resonated with thousands of views, shares, and feedback! Please do us a favor and like/share if you haven’t already. In the meantime, enjoy!

#93 VC DPI & Power Laws - What They Mean Today

VC Deep Dive Recaps - August Dear readers, thanks for all the great feedback on our August VC deep dives! We’ve gone deep on some notable VCs & unpacked some insights around building generational firms (#91 VC Deep Dive: Fresh Takes From Top VCs, #89 Brad Gurley (Benchmark) + David Sacks (Craft), & #87 Building Generational Firms). “Now more than ever, VC firms need to think strategically about their business model.”

#92 VC Reg & Legal Change - The Updates

VC Regulatory & Legal Change - The Updates Last week, we wrote about regulatory and legal impacts on VC funds and funds of all types (#90 VC Regulatory & Legal Change Coming). We flagged insights from one of our favorite legal and regulatory experts, Chris Harvey.

Paid Newletter- #91 VC Deep Dive: Fresh Takes From Top VCs

VC Deep Dive: Fresh Takes From Top VCs Dear readers, thanks for all the great feedback on our recent VC deep dive posts! We’ve gone deep on some notable VCs & unpacked some insights around building generational firms (#89 VC Deep Dive: Brad Gurley (Benchmark) + David Sacks (Craft) & #87 VC Deep Dives & Building Generational Firms). “Now more than ever, VC firms need to think strategically about their business model.”

#90 VC Regulatory & Legal Change Coming

VC Regulatory & Legal Change Coming Previously, we’ve written about regulatory and legal impacts on VC funds and funds of all types, private and public. It’s important for any VC CFO/finance pro or GP to know enough regulatory and legal to make sure they’re operating in a compliant and thoughtful manner as they grow their funds and firms.

Paid Newsletter- #89 VC Deep Dive: Brad Gurley (Benchmark) + David Sacks (Craft)

VC Deep Dives & Building Generational Firms - Reflections Last week, we dove deep on some notable VCs & unpacked some insights around building generational firms from said VCs (#87 VC Deep Dives & Building Generational Firms). We wrote that “now more than ever, venture capital firms need to think strategically about their business model.”

#88 Latest CFO Takes on the State of VC

State of Private Markets in Q2’23 Venture capital firms and industry providers have reported Q2’23 valuations and portfolio updates at this point. Pitchbook released the Q2’23 Venture Monitor. CB Insights shared the State of Venture Q2’23. Carta released the State of Private Markets: Q2 2023 report

Paid Newsletter- #87 VC Deep Dives & Building Generational Firms

Building Generational VC Firms - What Does It Take? Venture capital firms are re-assessing their position, processes, and investments in 2023. This includes the generational VC firms (ones that have been around >10 years and have had a lot of success) like a16z, First Round, Founders Fund, Kleiner Perkins, Lightspeed, Sequoia, Union Square Ventures, etc.

#86 VC Fund Stacks Are Back!

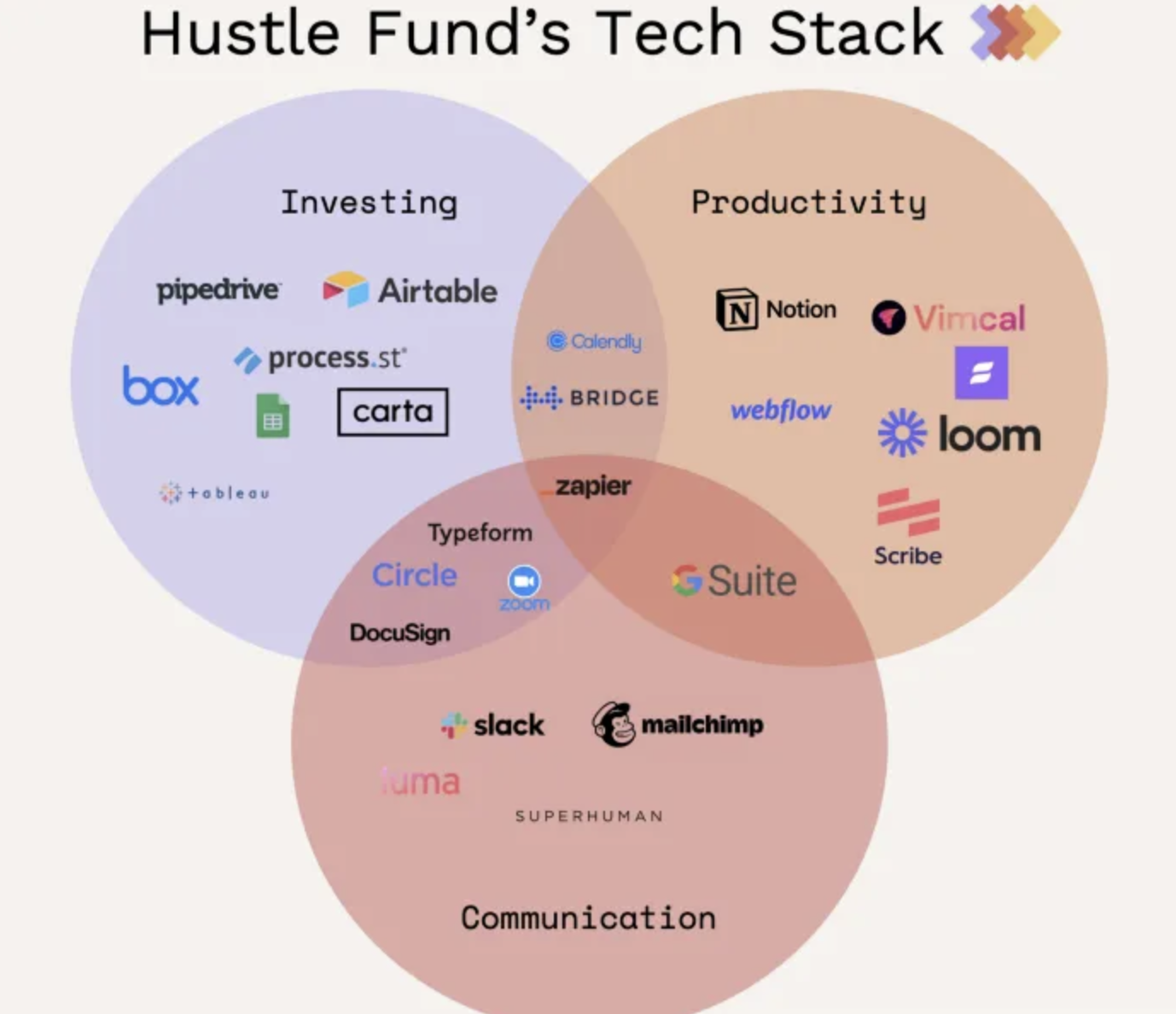

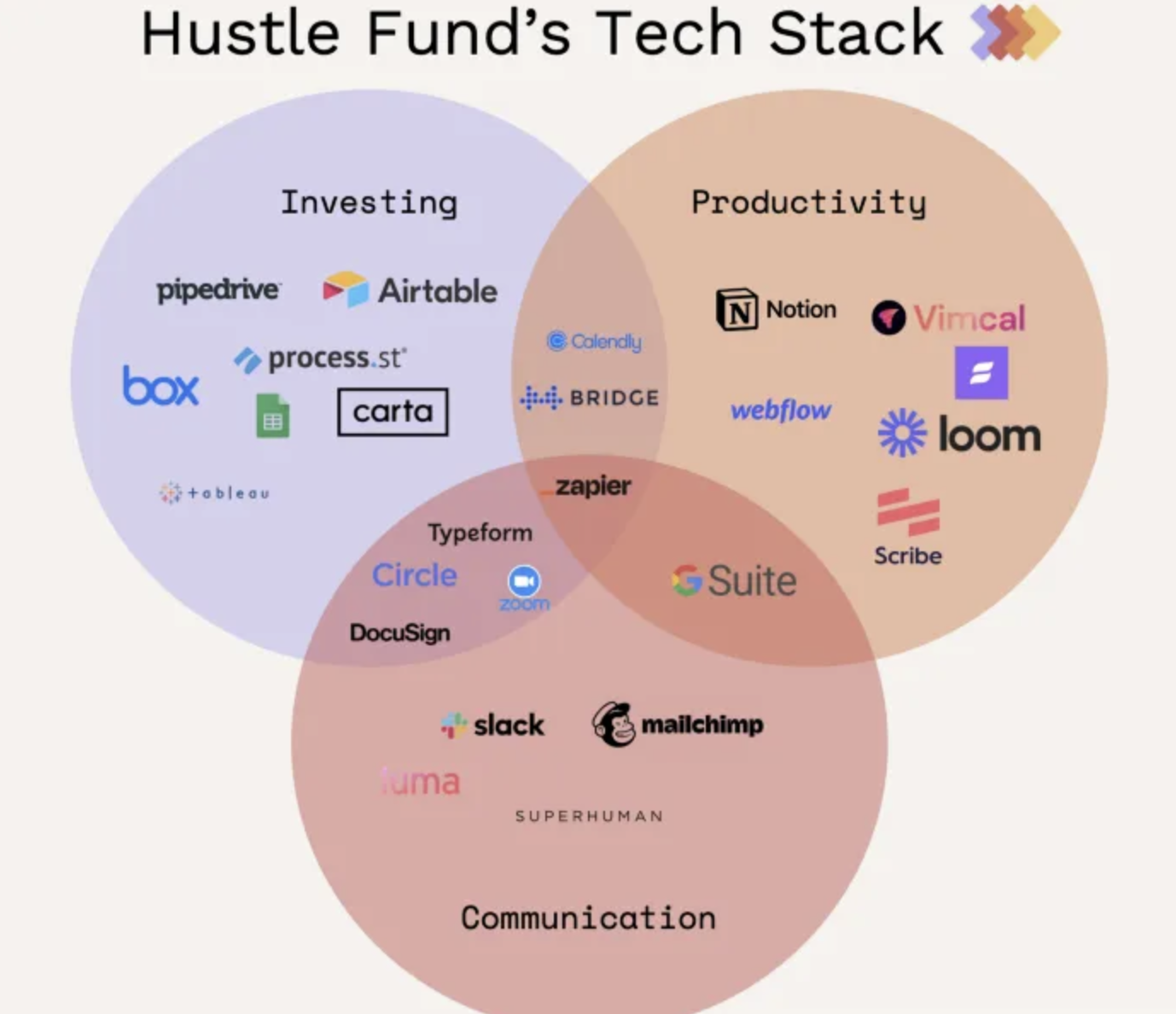

Emerging VC Fund Tech, Data & Efficiency Stacks “Emerging VC back-office complexity is a hell of a thing. The problem for most new managers is that there is an absence of what 'good' looks like when selecting fund admin, tax, and audit partners.” -Eric Bahn, The Hustle Fund

#85 VC Valuation Headlines & Policies

VC Valuation Headlines & Policies As Q2 VC valuation headlines start to come out, this is a good time to revisit your valuation policies and make sure they provide the right foundation for investor reporting. The latest headline on valuations was from Business Insider yesterday:

Top VC CFO Posts of June/July

Top 3 Posts by Engagement in June/July We’ve aggregated our top three posts from June/July - these ones really resonated with thousands of views, shares, and feedback! Please do us a favor and like/share if you haven’t already. In the meantime, enjoy!

#84 Differentiate w/ Data in VC

"If Everyone Has the Same Data, How Can You Even Differentiate?" This is the question that Andre Retterath (Data-driven VC) asked in his most recent post. It’s a topic that is on the minds of a lot of LPs and GPs in venture capital in 2023, when data and technology tools to leverage it are becoming more available. Even if you’re using them, are you using them better than your competition?

#83 Q2 LP Updates - Best VC Insights from GPs & LPs

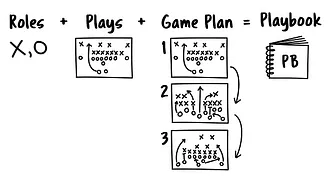

Q2 LP Updates - Best VC Insights from GPs & LPs If you’re a VC GP or CFO/Finance Pro, you’ve likely finalized (or are close to finalizing) your Q2 report and financials. At the end of each quarter, “The Playbook” requires VC funds to review and update their financial performance to investors. That means working with fund administrators / accountants to review portfolios and update company valuations based on your Valuation Policy.

#82 "Best Advice for an Emerging VC?"

What’s The Best Advice for an Emerging VC? Over the years, we’ve met with thousands of emerging VC managers and invested in / worked with hundreds. We’ve logged thousands of hours of research, reading, and listening to podcasts to pick the brains of some of the must successful VC and LP investors out there (who were all “emerging” at one point in time).

#81 Top VC Insights for Q3'23

Top VC Insights for Q3’23 Happy Tuesday folks - it feels good to be back writing! Today we’re sharing some of our top VC insights for Q3’23. We did a lot of holiday reading and have including our favorite insights, headlines, and articles as you kickoff the quarter. Enjoy!

#80 Closing Q2 w/ Playbooks, VC Fund Models, Budgets. +Q3/Q4 Outlook

The Quarterly Closeout Now it’s time to close Q2’23! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?! We looked back at our most impactful posts from Q2, which included the following:

#79 VC Insights in London, UK, Europe

Headlines Remind us London, Europe is a Big Deal for Venture Capital It’s been an exciting year thus far for London, the UK, and Europe more broadly. As increased regulation and scrutiny builds in the United States, we’ve seen a different approach to technology (including AI and web3) in London and Europe. Major VCs such as Sequoia and a16z have opened offices and made major investments. Here are some recent headlines that give context:

#78 "When Do I Hire a VC Fund CFO?" (vs. Controller, Fund Admin)?

“When Do I Hire a VC Fund CFO?” (vs. Controller, Fund Admin)? This is one of the most common questions we get as LP investors and VC CFOs for hundreds of funds over the past three decades (collectively w/ Eddie Duszlak). There’s no one right answer here! We think it’s best to simplify by asking yourself a question.

#77 VC CFO Q2 Review / Q3 Key Action Items

The Quarterly Closeout It’s June 15th and we’re two weeks away from closing out Q2’23! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?!

#76 VC Headlines Won't Stop, Inflation Down

VC Headlines Keep Coming - What You Need to Know & Pods for Travel So. Much. Action! VC headlines can’t stop won’t stop right now - so much for the summer slowdown! In the past week, we’ve seen some big news w/ big implications for VCs and LPs investing in some of the most notable technology sectors.

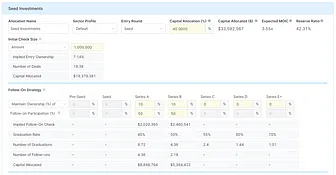

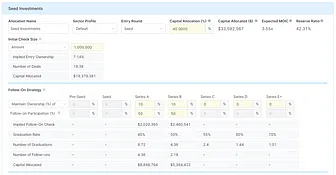

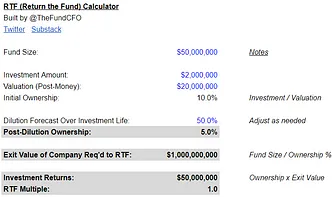

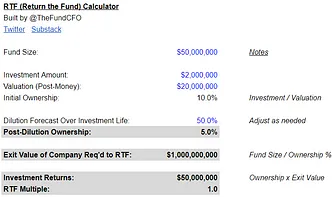

#75 VC Power Law & RTF Math (w/ Template)

How Venture Capital Really Works: Returns Are Driven by Power Law For years, we’ve been saying that every VC fund manager needs a fund model (portfolio construction and reserves). Why? A fund model provides a plan for investing, is often required by investors, and can drive outsized returns (and help avoid value-destroying mistakes)!

#74 Q1'23 Emerging Manager Report - Key Takeaways for VC

Our friends at Signature Block are back again with a new report! They collected 5,000 data points by surveying emerging managers in venture capital.

#73 Dealflow & What Really Matters in VC

We’ve been talking to a lot of LP investors and VC GPs lately about what really matters in VC. When you simplify what drives success (outsized returns) in venture capital, it boils down to a few simple concepts:

#72 What LP's Are Thinking About VC Right Now

Where is the world going and what does that mean for my investment portfolio? That is the general question all types of investors are asking right now! We’re reading headlines and digesting macroeconomic / industry data to understand what it all means for our various investment strategies.

#71 Data-Driven VC & Impact on Fund Finance

“VC’s are becoming more data-driven. More efficient. Supercharged by AI tools.” This is the common narrative today. But is it true? The reality is that most firms are trying. However, becoming more data-driven and efficient takes time and commitment to new tools, new processes, and execution.

#70 VC Platform (Founder Experience) & Hiring Insights

In our past posts @TheFundCFO Newsletter, we’ve covered a lot of ground, mostly related to fund finances, operations, and driving fund returns via models, budgets, technology, and processes. That’s good stuff but it’s definitely not everything! What we haven’t talked enough about is the portfolio companies and people that make all of that possible.

#69 VC Fund Audit Retro: Insights for 2023

Recently VC CFOs/Finance Pros and fund managers emerged from the depths of audit and tax season (that wrapped up end of April). Each year, VC funds are required to do an audit, where a third-party comes in and reviews all your financial reporting and accounting from the prior year to confirm it’s accurate. This is required for most funds out there and necessary for accurate tax reporting / payment.

#68 New VC Fund Playbook + Model Downloads @ Streamlined.Fund

New VC Fund Playbook + Model Downloads @ Streamlined.Fund As many of you know, I started working at a bank in 2007 before jumping to the PE/VC investing world in 2010. Nights and weekend advising flipped to full-time CFO consulting in 2018 via Airstream Alpha before Going Deep @ Chapter One in 2021.

#67 Top VC CFO Posts & References of April

In what’s becoming a [monthly] tradition, we’re resurfacing our top posts from last month for ease of access, as well as our top reads. We want to keep our top resources together for both our long-time readers and people just getting started on TheFundCFO journey. We also include back-links to top prior posts. Here you go!

#66 CFOs/Finance Pros Getting Smart on AI

“Every startup needs an AI strategy.” This includes VC funds! We wrote about this previously and how it relates to VC GPs and CFOs/Finance Pros (#56 The AI Lucky Truck @ Chapter One & #39 AI Takeover & Impact on VC Funds).

#65 WTF is Going On in VC (+ New Fund Model Data)

We’re through four months of the year and people are still trying to figure out what is going on in venture capital in 2023! We tried to tackle this in our recent post, #62: VC Market Data for Fund Model Updates, but the story keeps getting more nuanced as we get more data and insights.

#64: "Where Do I Start as a VC CFO?"

"Where Do I Start as a VC CFO / Finance Pro?" This is the question I heard from an old friend recently. He had 15+ years of investing and operations experience and was now one of three partners at a $100m fund. In addition to his day job of investing, one of his new responsibilities was finance and operations. “How do we bring the three partners together and build a real business?”

#63: Venture Debt Down (And 2023 Impact)

Venture Capital Investing is Down in 2023 (~$40b 2023 EST) “In 2022, startups raised about $75b from VCs. A number between $30b-55b would imply 30%-60% reduction in the early stage market.” This is the latest prediction from VC Tomasz Tunguz on the Venture Market in 2023.

#62: VC Market Data for Fund Model Updates

Model Updates: Use the Latest Market Data Now that Q1 is in the rearview and audit/taxes are done (we hope), it’s time to revisit those 2023 full-year plans, budget forecasts vs. actuals, and fund models!

#61: VC CFO Data & Efficiency Stack

The VC CFO Data & Efficiency Stack As referenced above, last week we talked about service and tech stacks for emerging VC funds. The framework we shared from the Hustle Fund included the “tech stack” across Investing, Productivity, and Communication circles.

#60 Emerging VC Fund Tech Stacks

“Emerging VC back-office complexity is a hell of a thing. The problem for most new managers is that there is an absence of what 'good' looks like when selecting fund admin, tax, and audit partners.” -Eric Bahn, The Hustle Fund

#59: VC CFO / Finance Pro Changes in Q2: More Action

Welcome to Q2’23! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?!

Top 5 VC CFO Posts of Q1'23

These are the top 5 posts by engagement for 2022 from @TheFundCFO Newsletter. Reflecting on them, the most popular had some sort of tool, playbook, or template. Readers continue to want actionable content that makes their lives easier - noted! I want to share a big “thank you” to everyone who read, commented, & shared. Please continue to share if you know someone who would enjoy!

#58: VC Growth: Angel to Fund 3+

VC Growth: Going From Angel to Fund 3+ We meet a lot of angel investors, VCs, and folks somewhere in the middle. Going from angel investor to VC is a journey, one that will require a whole new set of skills and mindset. But it can be done well with the right approach and tools!

#57: What's Next for Banks?

This is a guest post by bank expert Eddie Duszlak, who runs Virtuent, a systematic, market-neutral hedge fund focused on small-cap banks. He previously wrote #52 Bank Expert Analysis: Eddie Duszlak and a Verdad Weekly Research about quantitative models for investing in banks. We hope you enjoy his insights.

#56 LP Email Updates, Insights: Getting Hit By The AI Lucky Truck @ Chapter One

LP, Investor Email Updates Matter - Tips, Tricks, Insights for VCs & CFOs The email update is arguably the most important form of professional communication today! VC’s / fund finance pro’s request them from their portfolio. LP’s request them from VCs. If you master the email update, it can be highly efficient! You can message 10, 100, 1000 people all at once and let them know what's going on.

#55: Audit, Tax Deadlines & The Ultimate Year-End Checklist for VC CFOs

Checklists (Again) - Every Month, Quarter, Year 🙂 We’re almost at the end of March! Given that, it’s time once again to review our monthly, quarterly, and annual checklists and playbooks.

#54: Q4 Quarterly VC Update (Cooley)

CFO Highlights: Pulling Insights from the Top VC Resources We know there’s a lot of an amazing content out there. Here, we put our best VC CFO and LP hat on and filter the most relevant and helpful content so you don’t have to!

#53 Banks: The Final Chapter (For Now)

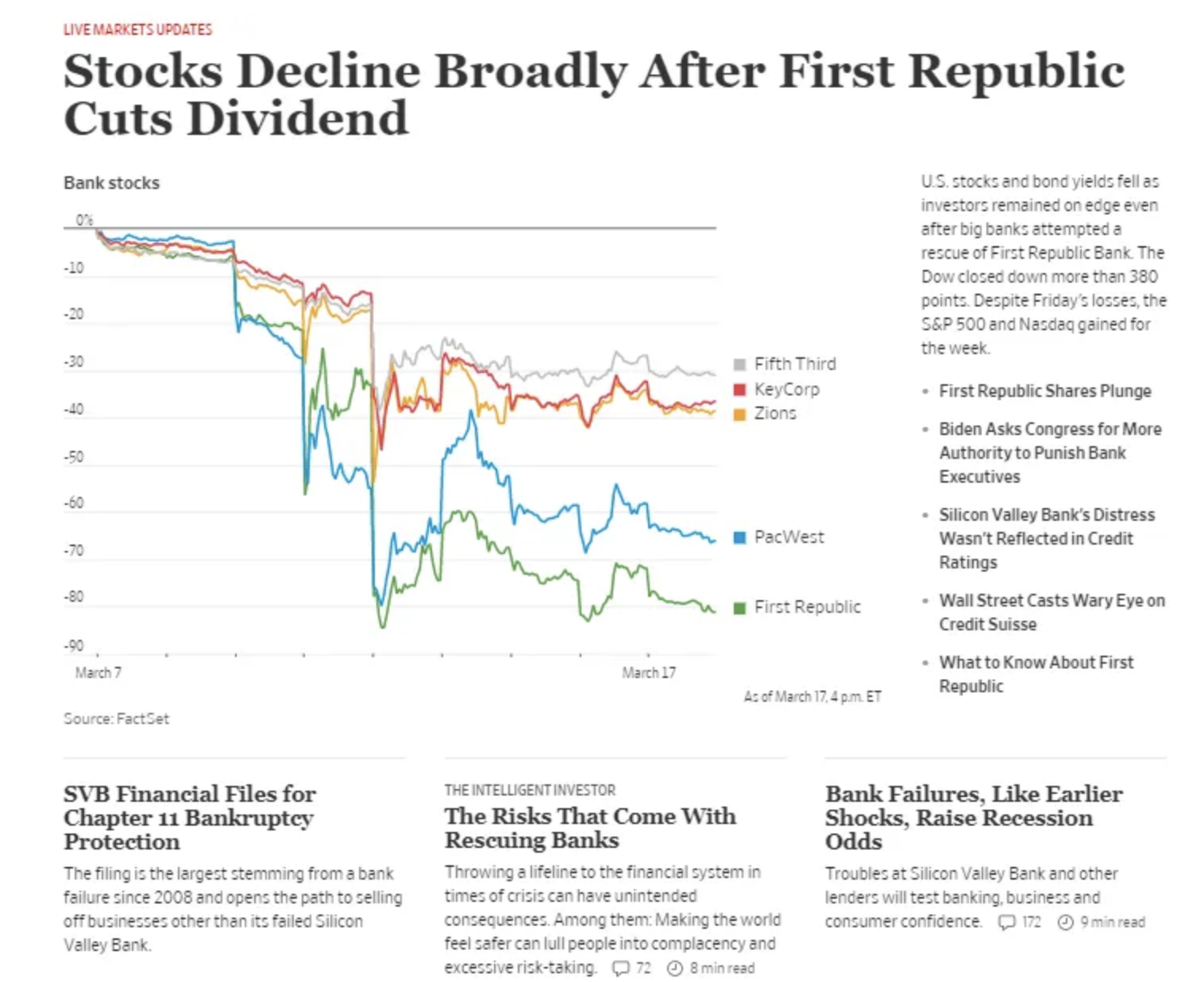

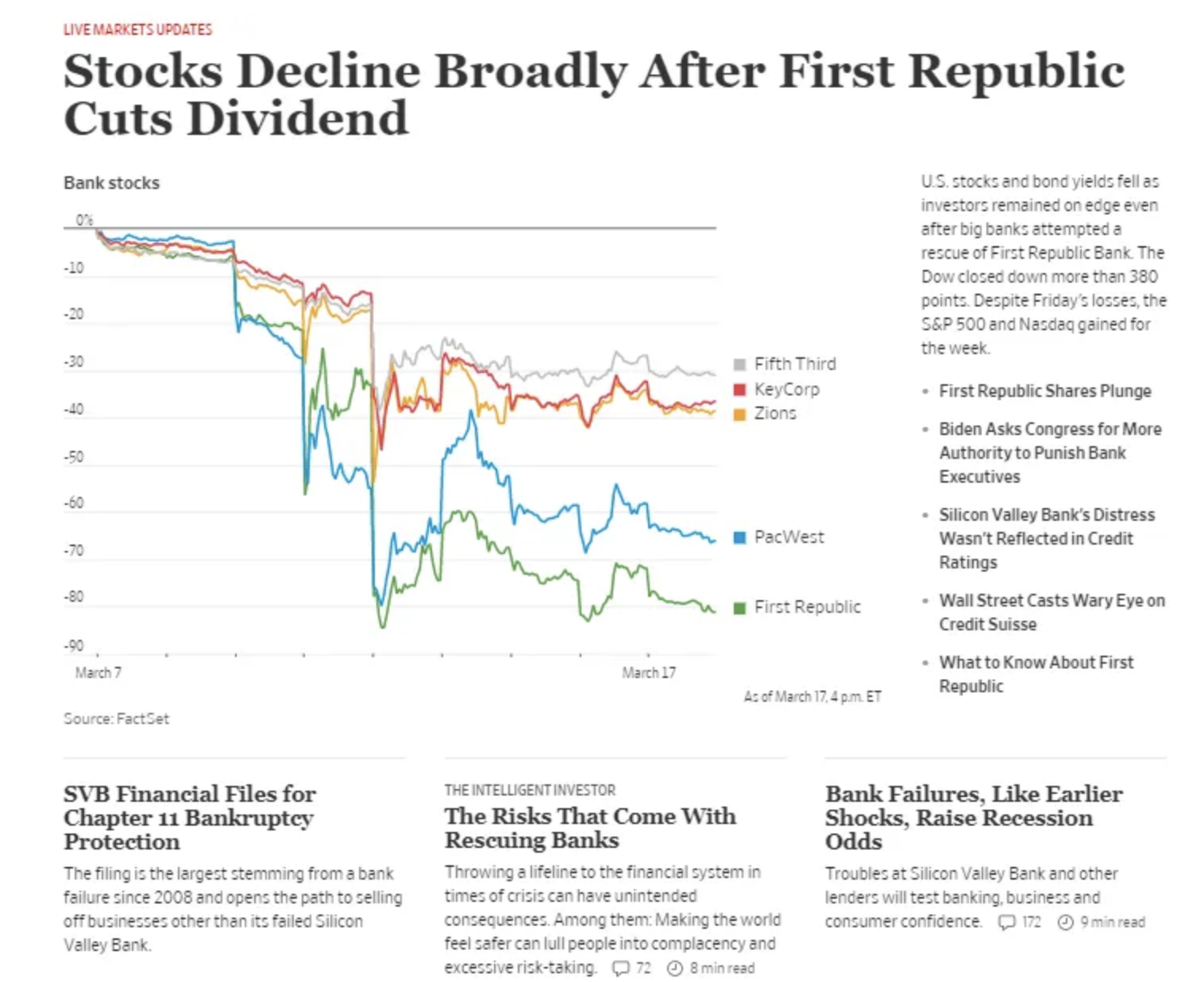

Bank news has dominated the headlines and mindshare of VC GP’s, CFO’s, and fund finance professionals over the past week. This is the third and final chapter (for now) of our commentary on banks as we try to get back to our normal programming

#52 Bank Expert Analysis: Eddie Duszlak

This is a guest post by Eddie Duszlak, who runs Virtuent, a systematic, market-neutral hedge fund focused on small-cap banks. He previously wrote a Verdad Weekly Research about quantitative models for investing in banks and we consider him a bank expert. We hope you enjoy his insights on the Silicon Valley Bank failure.

#51 Bank Blockbuster

“Silicon Valley Bank (“SVB”) is shut down by regulators in biggest bank failure since global financial crisis” It’s been a wild week for VC GP’s, fund finance professionals, startups, the tech industry, banks, investors, and anyone connected to these sectors, especially the last 48 hours.

#50 VC Resource: Mosaic Strategic Finance

Be a Strategic CFO, Finance Pro or VC - Learn from Mosaic. Mosaic aims to be the “strategic finance platform for the entire business.” We love taking examples from finance platforms like this one and applying them to VC.

#49 CFO Monday Night Macro

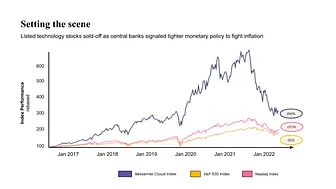

What’s happening: Last week, CPI (Core Price Inflation) and PCE (Personal Consumption Expenditures) data came in above expectations. This means…

#48 VC's & LP's in LA for Upfront

For VC GP’s & finance professionals, it’s been a busy start to the year! Same for LP investors. The grind took a brief pause (or new focus area) this week as >1,000 VC professionals, LP investors, and founders descended on LA for the Upfront Summit. I first attended the Summit in 2016 as a LP investor - it’s grown a lot since!

#47 March Checklists (Finance & Legal)

Welcome to March! It’s the first day of the month and my calendar reminder is telling me to review our monthly, quarterly, and annual checklists and playbooks.

#46 CFO Monday Macro: 5.5% Rates Coming

In early January, we shared insights in #29 CFO Macro: 2022 vs. 2023. We looked back at 2022 and shared some notable predictions for 2023. We started our Monday macro series earlier in February (#37 CFO Midnight Macro (2/6), #40 CFO Monday Macro (2/13), #43 CFO Monday Macro (2/20)).

#45 Pace Yourself VC's! 2023 Pacing Update

For those that don’t know, I started as a LP investor back in 2010. I led investments in both larger, more established funds (i.e. True Ventures, Founders Fund, a16z) and smaller, newer funds (i.e. 137 Ventures, Costanoa, Placeholder).

#44 VC Liquidity Mgmt.: Buy or Sell?

It’s February 22nd, 2023. VC GP’s and investors, finance professionals, and their LP investors are emerging from their annual review of investment portfolios. The last couple of years were a unique time to invest, manage, and sell. As Fred Wilson shares, selling is perhaps “the hardest part of the investment discipline.”

#43 CFO Monday Macro

In early January, we shared insights in #29 CFO Macro: 2022 vs. 2023. We looked back at 2022 and shared some notable predictions for 2023. We started our Monday macro series earlier in February (#37 CFO Midnight Macro (2/6) & #40 CFO Monday Macro (2/13)).

#42 VC's in 2023: No Rush to Deploy $300B of Dry Powder

We’ve spoken with >100 VC’s and fund finance professionals so far in 2023. The big takeaway is that VC’s are moving slow. After the breakneck speed of the last few years, many fund managers are in wait-and-see mode right now.

#41 VC Resource Wed: More Fund Models!

Moonfire: How to Design the Optimal Venture Portfolio Moonfire, a London-based VC, released their portfolio simulator last week. I’ve been impressed!

#40 CFO Monday Macro

In early January, we shared insights in #29 CFO Macro: 2022 vs. 2023. We looked back at 2022 and shared some notable predictions for 2023. We started our Monday macro series earlier in February (#37 CFO Midnight Macro).

#39 AI Takeover & Impact on VC Funds

AI (“Artificial Intelligence”) continues to dominate the headlines across the VC and technology industries, with potential impacts for many others.

#38 VC Resource Wednesday: Fund Models

Fund Models: Go From a Beautiful Disaster to a Return Driver For VC/PE/hedge fund managers and investors of all types, fund models matter! A lot! Sure, every investor needs to be able to access and pick great investments.

#37 CFO Midnight Macro

In early January, we shared insights in #29 CFO Macro: 2022 vs. 2023. We looked back at 2022 and shared some notable predictions for 2023. One month into the year, we’re tracking “ahead of plan.” More on that below!

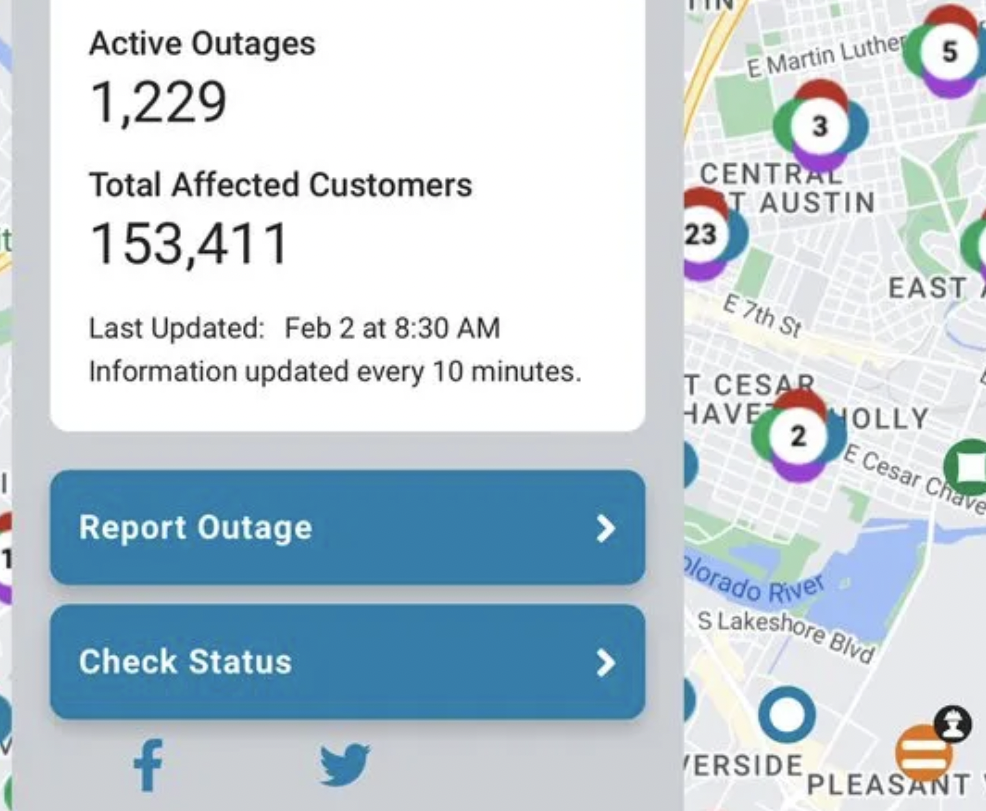

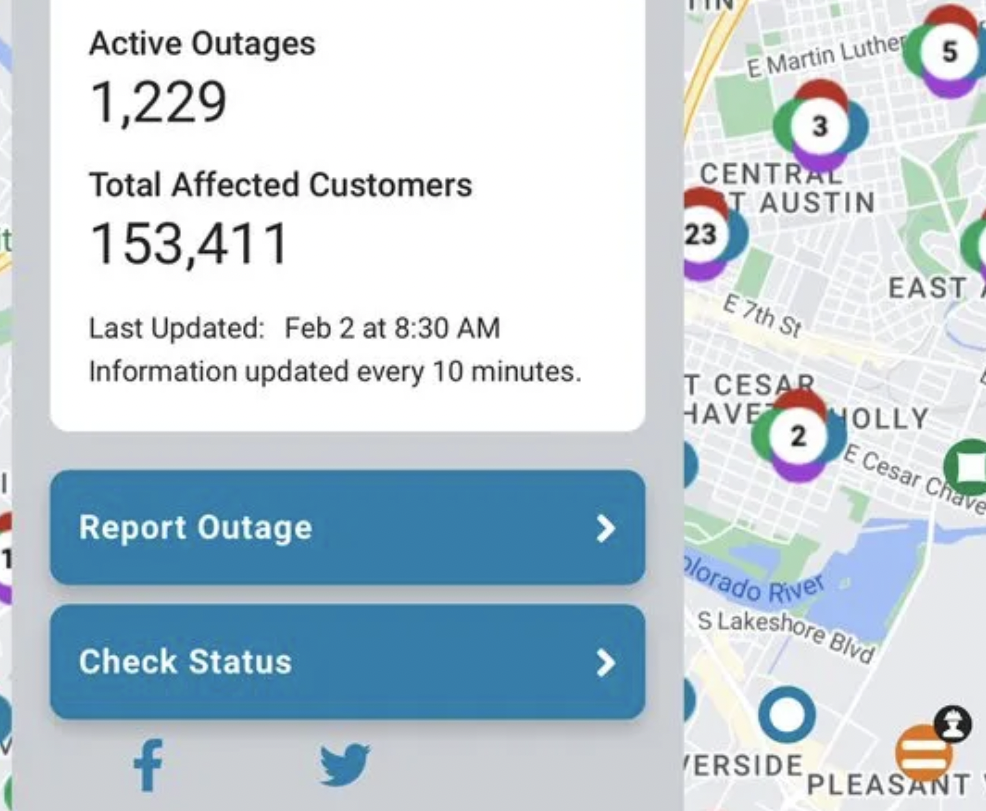

#36 Power Outages & Playbook Execution

When the Power is Out, Keep Executing with the Right Playbook!

#35 VC Resource Wednesday

Welcome to the VC Resource Wednesday. Each week on Wednesday, we’ll highlight some of our favorite resources for #VC CFOs and fund managers, #LP investors, and general industry enthusiasts/ people who want to learn.

#34 CFO Monthly Monday

Monthly Monday - January Wins, Top Posts, & Takeaways

#33 VC Resource Wednesday: Signature Block

This week, we’re highlighting Signature Block! Ryan Hoover and Vedika Jain from Weekend Fund started Signature Block “to crowdsource advice and learnings from experienced GPs and to make this the best resource for fund managers.”

#32 VC Key Terms For Emerging Managers

VC Key Terms - Getting in the Game as an Emerging Manager

#31 VC Fund Model & Budget - Free Download

You asked for it! Making our most requested templates available here!

#30 VC Fundraising in 2023

Our take + new insights from 20VC's Harry Stebbings

#29 CFO Macro: 2022 vs. 2023

Gm crew! Remember, you can’t spell “fund finance” without “FUN.” 🚀😎

#28 VC Valuation Resources & Policies @ Q4

Welcome to the new members of @TheFundCFO crew! Every [week] or so (#goals), we’ll bring you actionable tools, real-world experiences, and insider insights for #VC CFOs and fund managers, #LP investors, and general industry enthusiasts/people who want to learn :).

Top 5 CFO Posts of 2022

These are the top 5 posts by engagement for 2022 from @TheFundCFO Newsletter.

#27 The Playbook + VC Budget Template

Win 2023 with the playbook & Excel VC Budget Template

#26 How to Be a Great VC CFO

We asked the AI-powered ChatGPT for their take 🙂

#25 Year-End CFO/Finance Checklist

Apply the checklist + software principles to position your fund for growth in 2023

#24 VC CFO Insights From Weekend Fund

Crowdsourced knowledge from experienced GPs & LPs, all in one place!

#23-Point Fund Launch Checklist (3.0)

Effectively managing #VC fund (or any fund) launch

#22 Monthly Metrics Matter! Just Do It!

Every business (including VC funds) should have a set of metrics that it tracks regularly

#20 Next Level Portfolio Construction w/ Software - Why It Matters 🔥

Insights from Tactyc founder Anubhav Srivastava on VC fund portfolio construction

#19 Q4 & The Year-End Sprint 🏃

Apply product sprints and the Q4 checklist to close the year strong in finance

#18 @TheFundCFO Newsletter: Year 1

Recapping one year of writing + all the articles published for reference!

#17 RTF (Return The Fund) Math

Use a simple RTF calculator (linked below) to make superior investment decisions

#16 Quarterly Valuation Time!

Short and sweet! Expert resources & insights for valuing your PE/VC portfolio

#15 WTF is Fund Accounting (& why does it matter)?

A collaboration with Halle Kaplan-Allen, Director of Revenue at Sydecar

#14 Strategic CFO Halftime Show

How to be "strategic" (aka more valuable) in the second half of 2022

#13 Closing Q2 + The Checklist

A quick checklist approach to wrap-up Q2 finances and win the rest of the year 🙂

#9 VC Opportunity Fund Insights

Start here when raising your VC Opportunity Fund

#8 Fundraising - Show Me the Money!

Fundraising, de-mystifying LPs, and breaking down the process, step by step

#7 The 7 Fund CFO Priorities

Defining the top priorities to modernize your finance & back office

#6 A #VC Fund is a Business. Use Efficiency Tools to Modernize Your Finances & Back Office

Use the right playbooks, checklists, and file organization to deal w/ increased complexity!

#5 Demystifying Fund Admin (Accounting + Operations)

Find the best fund administration "fit" for your #VC fund

#4 Fund Launch Checklist (2.0)

Launching a #VC fund (or fund of any type) can be overwhelming - use a checklist!

#3 VC Fund Budget (ASAP)

"ASAP" = "As Simple as Possible" -> We'll send you our budget, just ask!

#2 VC Fund Model (Back to Basics)

The fund model doesn't need to be hard! Start simple! We'll send you ours, just ask!

#1 So What’s a VC Fund CFO?

Building Your VC Fund Finance for Investors (from an investor POV :))

#0 Build Your VC Fund Finance & Back Office

Welcome to @TheFundCFO Newsletter by me, Doug Dyer. I’m the CFO @chapterone, a rapidly growing $50m+ pre-seed investment firm led by @jmj. I began......

Airstream Alpha Update & Fund Highlights

We’re fortunate to be working with a great group of partners from coast to coast and providing support to a number of others as they launch and build their funds and investment firms.

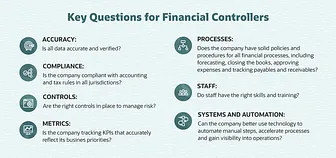

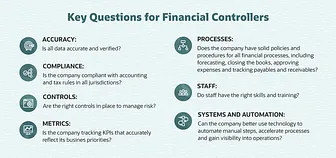

Own The 7 Fund CFO Priorities

Most funds we work with advise the companies they invest in to build a great leadership team (often including a CFO). Yet many funds don’t have a CFO on their own team. Why is that?

Top 10 Reasons to Up Your Budget Game

This week, we are revisiting an important conversation in venture fund management - budgeting!

23 Point Checklist for Launching a Fund

We’ve been hearing from a lot of people launching funds that they need a list to help them prioritize their time, build the right processes, and make more informed decisions.

VC Funds: The 7 Core Finance Files You Must Have

Setting up the right processes and structures early can prevent future challenges with things like financial reporting, financial forecasting, audit, and tax.

SVP Need for Speed

One topic that is coming up daily with the funds and investors we work with are SPVs.

Tech Stack, Portfolio Construction & Growth

“What’s the right venture capital technology and services stack?” We get this question often!

The Hustle, Expert Field Guide

& (Legal) Mechanics

We shared these in response to a lot of questions we were getting on launching and managing a fund...

Venture Capital Fund

Launch Series

Recently, when we’ve asked new and prospective fund managers what problems and frustrations they face...

2020 Recap, 2021 Preview &

Giving Back!

It’s been a heck of a year and our heart goes out to all those impacted - we’re hopeful that 2021 beats 2020!

Fund Financial Model Template / Fund & Entrepreneur Resources

Successful fund managers are typically elite at sourcing and investing in great companies.

Venture Capital & Growth Fund Reserves / Entrepreneur Resources

Venture Capital & Growth Funds are talking to us a lot these days about reserves modeling. What exactly does that mean?

Growth Equity Fund Support & Resource Highlights

Meet Avenir, a future-focused growth equity fund backing category-defining companies. Since launching in 2017, Avenir has led financing rounds totaling...

Investment Firm Launch & Entrepreneur Resources

Since 2018, we’ve worked with >25 companies that have generated millions in revenue and raised >$500 million

Welcome to the Airstream Alpha Newsletter

Hello friends! Doug Dyer here, I hope this email finds you safe and well. Welcome to the first edition of the Airstream Alpha newsletter.

- Austin, TX

- info@airstreamalpha.com

© 2020 Airstream Alpha, LLC All rights reserved. Privacy Policy • Site by Six Minutes Late Marketing & Design