Airstream Alpha provides Modern CFO & Back Office Solutions to entrepreneurs & investment firms, specifically venture capital, private equity and hedge funds, as well as bespoke investment vehicles.

Our team has extensive experience working with and investing >$1 billion in >100 investment firms and companies (thousands evaluated).

Learn more about what we do, tell us about yourself and how we can help at www.airstreamalpha.com.

TLDR

- Fund Launch Series Part 3 of 3: Build Your Budget

- How much does it cost to start and run a VC fund? Our budget helps you answer that question!

- “Spending is not always your enemy” – minimizing expenses may maximize investable capital, but can also limit a VC’s ability to do their job effectively

- Emerging VCs with small teams should employ a “team-building” mindset, and think of service providers as extensions of the team, and not just necessary evils

- What’s next? Check out our Modern CFO & Back Office Strategy Guide for guidance!

Thanks for tuning in to the final installment of the Airstream Alpha “Fund Launch” series, Part 3 (if you missed Part 1 and Part 2, read it here and here first). Good news! We have another short and sweet post for you, as we try to pull insights from what we already shared in this interview with Oper8r.

Successful fund managers are typically elite at sourcing and investing in great companies. In the background, they are also running a business, which has revenues, expenses, and legal obligations which can get complicated fast!

On average, we have found that new fund managers can spend upwards of 100 hours just establishing their fund and setting up operations (law firms such as Cooley and Vela Wood have a number of free resources on their websites). There are a lot of considerations when starting a new investment firm and the decisions you make will have real implications on attracting the right investors (typically referred to as Limited Partners or “LPs”) and the fund’s bottom line.

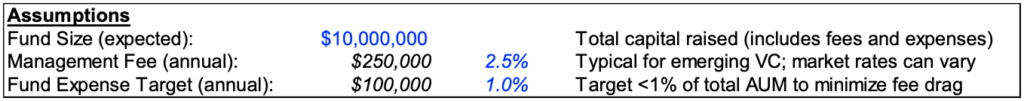

Let’s go through an example together to show how an emerging venture capital (“VC”) manager can think through the financial implications of establishing their fund. We’ll use the following assumptions in this article.

Fund managers can think of expenses in three buckets:

- Organizational expenses: costs associated with forming the fund (legal, accounting, setup, organizational, marketing, etc.). These are typically capped at a fixed dollar amount, depending on the strategy and investors. To simplify the discussion, these are not the focus of this article.

- Management Company expenses: the primary focus of this article, management company expenses are required to “run the business,” such as salaries & benefits, your VC tech stack, and operating expenses.

- Fund expenses: costs related to the fund and portfolio companies, such as fund administration, fund audit & tax, travel & entertainment related to acquisition, disposition, and holding of fund investments. These expenses are paid by the fund, not the management company, so they don’t impact the management company budget. However, they do reduce net returns to investors, so managing prudently is important.

No matter the expense category, it’s important to strike the right balance between spending money on things that are important to your core business (driving fundraising / deals / returns) and “the extra stuff.” For an emerging VC, “extra stuff” might include salaries from hiring too quickly, extensive travel and marketing spend.

If you aren’t careful, you can end up overspending quickly. What type of office space do you need – fixed or flexible? Do you need an expensive research platform, or can you attain similar insights in other ways?

Questions and decisions like these will impact your bottom line. Again, it’s a balance, and ultimately your investors are trusting your judgment to spend money on what will drive great investments and great returns!

Management Company Expenses & Fund Model

Management company expenses are required to “run the business.” Potential LPs often ask to see an example budget to understand how a fund manager is operating. Generally, LPs prefer that fund managers use this capital to invest in their team and resources, instead of generating large profits for the general partner (“GP”). Returns from investments and ultimately carried interest should be the larger, more meaningful driver of returns for the GP.

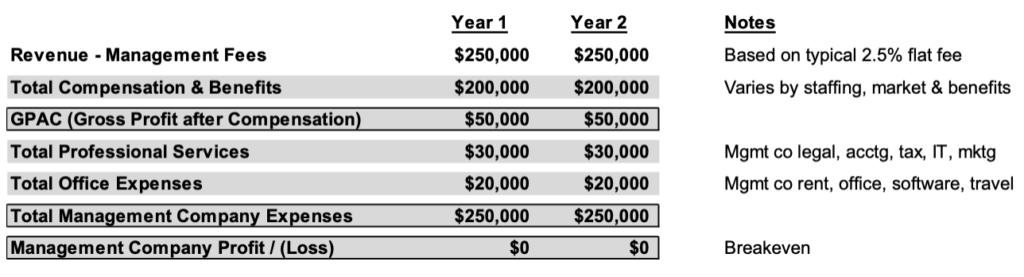

Here’s a basic example of a two-year management company financial model based on the assumptions previously outlined:

Fund Expenses (Target <1% of Fund Size)

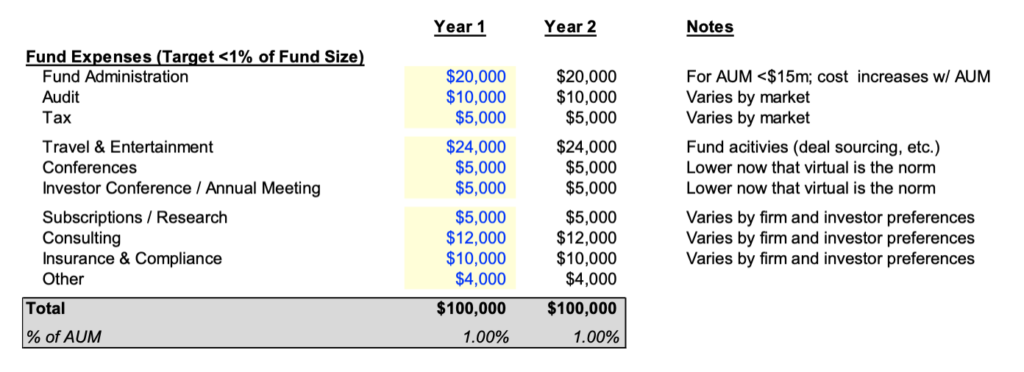

Fund expenses are costs related to the fund and portfolio companies, such as fund administration, fund audit & tax, travel & entertainment related to acquisition, disposition, and holding of fund investments. It’s generally best to keep these at <1% of the fund size to minimize the fee drag on net returns to LPs.

Additionally, your ability to manage these expenses will be of value in future funds as LPs look at this expense ratio to ensure the maximum amount of their committed capital goes towards fund investments.

Here’s a basic example of a two-year fund expense forecast based on a $10m fund size and general market rates:

Final Thoughts

A key goal of any fund manager is to maximize return for LPs and themselves by sourcing and investing in the best companies. In the background, forecasting and managing expenses requires valuable GP time and attention.

With proper planning and setup, this function can be effectively managed and help drive greater returns, build trust with LPs, and increase the likelihood of successfully raising a follow-on fund.

That’s a wrap on our Fund Launch Series! We appreciate you reading and sharing with your network!

Special thanks to David Perretz for his significant contributions to this article.